315 N. Oxford Dr.

Arcadia, CA 91007

Price: $980,000 ($463/sf)

- Beds: 2

- Baths: 2

- Sq. Ft.: 2,117

- Lot Size: 14,680sf

Today’s property is a short-sale listing for $120,000 more than its 2006 purchase of $860,000. I’m certain that the buyer went through the following thought process:

- Purchase this fixer-upper with 100% financing.

- Borrow more money for extensive remodeling and upgrades.

- Re-sale the home for $1,300,000+

- Profit!!

But in the absence of double digit housing appreciation, this deal has horribly gone sour and now the owner is stuck with a $1,000,000 fixer-upper. What a shame too because this section of Peacock Village is very nice and beautiful.

Listing description:

2 BED 1 BATH 1 STORY HOME WITH LARGE FIREPLACE IN FAMILY ROOM. NEWLY PAINTED THROUGHOUT. SHOWS WELL BUT NEEDS SOME TLC. SHORT SALE SUBJECT TO LENDER APPROVAL. ALL OFFERS SHOULD BE ACCOMPANIED WITH PROOF OF FUNDS LETTER, PRE APPROVAL AND FICO SCORES.

Last month I profiled a nearby home: Uninformed on Oxford. In that post I valued the property at $347/sf. Since this is a fixer-upper, let’s take a look at the valuation range:

$310sf -$656,270

$320sf -$677,440

$350sf -$740,950Currently listing for $980,000 ($463/sf)

Take a look at the above photo… Would you spend nearly $1,000,000 for this home?

Asking $120k more than 2006 price and still is a short sale and requires TLC? WTF.

Both the owner and the lender deserve to suffer in financial hell.

I do not know what is under Peacock Village, but asking nearly $1 million for a rundown 2/2 in 2008 simply is out of this world.

Totally agree with George8, are these people living in some alternative universe.

If the purchase price was $860k in 2006, which was close to the peak, then drop 15% to 20% off of that price at the very least.

My prediction, would be $575k to $625k.

Harsh, unemployment is at 7%, and rising, the Alt – A, option arm crisis is just starting to hit.

Who want to guess on the impact of the Option ARM crisis to the Arcadia area? Will it have a greater impact then Sub Prime crisis.

Someone please explain to me first who buys a 2bd 1ba home? Not a family! How about at a $1M price point what bank would appraise that out?

There are so many of these types of deals all over SoCA that’s why I see the RE collapse lasting into 2010-1.

So the bank will take the monthly utility and semi annual property tax hits for 12-18mos until reality sets in and the home goes for $500k?

One million dollars for 2 bedrooms and 1 bath?!

“Shows well and needs TLC?!!”

Everyone note the big brokers wouldn’t touch this sinker with a ten foot pole. It’s listed by a no name realtor.

The sellers would have better luck buying Lottery tickets!

If it weren’t for outrageously overpriced properties like this one, I wouldn’t have started this blog.

I have lived in the San Gabriel Valley for almost 20 years and always knew that Arcadia would be more expensive than its surrounding neighbors. But to carry a double or even triple premium?

If it was really about the school district, I’d buy a shack in San Marino for $1MM and send my kids to school there instead. But hey, even that $1,000,000 can get you 2,000sf single family home (on a busy street).

I agree with you. $575 is even being generous. It’s a 2BR fixer. If you have to put $150K in to fix it, you still have a 2BR home with one bath.

I would buy this home today for ~$425K. And I would try to fix it for $75K and live in it. I think that’s is true value. Sure it has a nice yard, but unless there is a gold mine under it, then $860 is way to much.

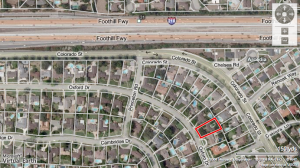

Check out the pool in the map view. It’s green with algae, I hope the city saw that and had them pump the pool out before it hatches a million mosquito’s. What a dump!

A couple of things on this one:

First, the listing agent is out of the area (West LA) and didn’t even list it in the Arcadia Multiple Listing Service. This automatically eliminates 90% of agents from even knowing about this home being on the market.

Second, it’s ridiculously overpriced at $463/sq.ft. when homes are selling in the low $400/sq.ft.

Third, it’s sad that a lot of agents do not understand how to price short sales. The price is not set by the bank but by the agent and seller. The bank doesn’t even want to look at pricing on a home sale until a bonifide offer is submitted to them. Only at that point, will they review the offer against their guidelines and make a determination on how much of a loss they will take on a home.

It just doesn’t make sense to price a short sale higher than the going homes on the market. The idea is to price the home low and negotiate with the bank on the sales price once an offer is received.

Looks like this home will be sitting on the market for quite a while.