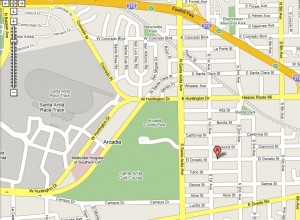

123 Eldorado St #A

Arcadia, CA 91006

Price: $589,000 ($405/sf)

- Beds: 3

- Baths: 2.5

- Sq. Ft.: 1,453

- Property Type Attached, Townhouse

OWNER PURCHASED THIS PROPERTY AT YEAR 2005 FOR $575,000 AND SPENT $20,000 TO UPGRADE KITCHEN COUNTER TOP, CABINETS, HARDWOOD/TILE FLOOR AND GARAGE FLOOR. THIS IS PRICED TO SELL.

Here’s a seller hoping to get out of his 2005 purchase with a minimal loss. Assuming the $20,000 spent on upgrades is true, here’s where he currently stands:

2005 Purchase – $575,000

ADD Upgrades- $20,000

ADD Agent Fees – $35,340

MINUS Sales Price – $589,000Total loss = $41,340

Unfortunately, I do not think $589,000 is “priced to sell”. Other PUDs in the area are similary listed at $405/sf but actual sales are closing between $300 to $360/sf. At 1,453sf, this property should fall within the following price range:

$435,900 $300/sf

$479,490 $330/sf

$523,080 $360/sf

A neighboring PUD, newer and bigger, is currently listed at $404/sf and has been sitting unsold for 222 days. Will this seller suffer the same fate?

Priced to sit for sure.

Doubt $20k was spent on upgrades.Not on that tiny kitchen and hardwood for just the second floor? Someone is lying.

The houses in this area are still, at least, 20-30% over priced, so we see an almost frozen market right now. The reasonable market price is eqivalent to the price at early 2004.

As you can see more and more 2003 buyers put houses on the market to bail out at 2005-6’s price. To me that is no sale.

The sellers need to understand the current mortage application stand to price to sale. Priced at 2005 level won’t help nowadays.

My opinion: Significant price drop to come after summer (school starts). After Chinese stock market drop to 20 months low. There is no Chinese to save our housing market any more. Even worse, they probably will try to cash US out to invest Chinese instead.

what is PUD?

llking,

PUD = Planned Unit Development

There are a handful of definition for PUDs but in this case it is development consisting of a group of individually owned lots that share common area and/or facilities. This common area is typically owned by the homeowner’s association that you are a part of after moving into the development.

They are also referred to as detached-condos or courtyard homes. You will also see plenty of “townhome PUDs” that actually share some walls.

Common areas are usually the shared driveways, general landscaping and trash holding areas.

Assuming it can rent for $2500. Its rent equivalent price for owner occupant is $400k(GRM 160).

It will get there in the near future.

You may call those who bought the house now are “nife catcher”. The truth is, nobody is sure about which direction the market will go from here. If not for investment, for those who purchase house to live for next 10 years the the only question is, can you afford?

Unfortunately, most at here are who can’t or the only hope is if the house price in arcadia can go lower. Wishful thinking I’d say.

The price will definitely go down from here. If you buy it now at 2005’s price and stay for 10 years, you will not have any gain and you have to pay tax and maintainance. However, you will be a house owner with honor.

Priced to SIT. The market is just sitting and I see very little turnover. The same homes go on and off the market in my area. I think the upcoming ARM resets will crack the bubble once and for all. This market isn’t coming back any time soon. 2009 is wishful thinking.

I want to an open house this weekend, and the realtor had a “facts” sheet with payments. ALL payments required 20% down (about 180K) and the payments were high!

Good luck finding fools to put 20%/180K down on a home that they feel is going to fall 20-30% in a few years.

I just love the market returning to the fundamentals! In a normal market the homes might go up 4% year, so there is no rush. Even if you miss the bottom you only lose 4% by waiting a year and finding a house you truly want to buy.

Ken:

>> The truth is, nobody is sure about which direction the market will go from here. If not for investment, for those who purchase house to live for next 10 years the the only question is, can you afford?<>Now it is a selling point that some idiot paid bubble prices in 2005? This statement is actually quite revealing of people’s perception of value in the housing market. The reality is that prices were inflated far above fundamental values by loose credit and unsustainable financing terms. The perception is that peak bubble prices were fair value and today’s discounted properties must be undervalued; therefore, if you buy now, you will be far ahead when prices quickly rebound back to fair value. In fact, there was a recent post at the OC Register where a supposed expert claimed prices are undervalued. Realtors should be pleased when I show a house with a huge loss because that means it is really undervalued.<<

http://www.irvinehousingblog.com/blog/comments/weeping/#more

Somehow my own comment was truncated in my last post. It reads as follows:

Ken:

Are you serious? Where have you been. It indeed is a misleading statement even for a realtor. IrvineRenter has an excellent observation:

Hi Arcadian,

Thanks for the definittion.

PUD is rare in the Northwest. Most if not all condos/townhomes have shared walls and properties.

LLKING

Anecdotal evidence. Over this past weekend, a friend commented that he wants to get rid of his current home of 2500 SF and gets a smaller one. Behind this whole story is that they can’t afford the payment anymore even though it’s fixed. Both being single, they feel left out on a lot of activities due to house poor.

Why do people continue to harp on the $ value homes? Could we just buy what we can afford recgardless of whether it is overpriced or undervalue? Why do people always look at a home as an investment and not just as a home? If you have the money and are willing to pay for the asking price, what is the problem with that? If someone want to play the investment game, bet on stocks. I love to make it mandatory to have 20% down before you can even be considered for a loan. That way we will only have serious buyers, no speculators to inflate the prices!

Anonymous:

>>If you have the money and are willing to pay for the asking price, what is the problem with that?<<

It is a perfect realtor talk. So are you one?

Actually, that is exactly the problem. The prices are so artificially inflated that most people can not afford their own homes, especially in many regions in CA.

Take today’s profiled property as an example. It will take household income of more than $150k and downpayment of $110k to afford. It is a small 3 beds a500 sf PUD unit.

Take away the bubbly equity and credit, I do not think you can afford much on your earned income either, at least much less than you think you can.

I also believe that speculation should be taken out of the housing market. But because prices are currently so inflated, I’d rather buy a home, previously listing for $700k, two years from now at $500k.

That’s a total decline of 28% and doesn’t seem far fetched when you consider than we’re 1/3 to 1/2 of the way through that.

I don’t think primary residences were commonly referred to as “investments” until after 2003 and the recent mortgage giveaway mania. Of course vacation and apartments were, but not primary residences — maybe because I was hanging out with the less moneyed crowd?

>>If you have the money and are willing to pay for the asking price, what is the problem with that?<<

Not a problem if you can live with following scenarios

1) a few months after the close of escrow, your neighbor’s house which is similar to yours goes on for sale for $100k less than what you paid.

2) a few months after the close of escrow, you found your dream house asking for the same amount of money your paid for yours

3) a few months after the close of escrow, you attend your friend’s open house party and found out that her/his house is much nicer and he/she paid much less.

4) 3 years after the close of escrow, you found a new job and have to move to another city. You think about selling your house, but find out that your neighbor’s house is still on sale (for much less of course). You rent your house out, luckily the rent covers the mortgage and you move to another city. You can not afford to buy another house because the loan underwriting rule is so tough that you can’t get 2nd mortgage unless you have 2nd income.

5) 10 years after the close of escrow, the market finally recovers. Your house is sold and you get your down payment and principles back. You are a happy man again, but looking back you suddenly realized that you are back to where you were 10 years ago. Keep renting would be much better choice!

To Anonymous

RE: “Why do people continue to harp on the $ value homes? Could we just buy what we can afford recgardless of whether it is overpriced or undervalue?”

Are you kidding, or are you just another ignorant realtor?

We “harp” on the $ value of homes because you should always buy a product at the right price. In case you don’t know the $ value is what determines the payment. And for cash buyers why spend an extra $200K today when you can wait a year.

People who just focus on payments alone or what they can “afford” are idiots. Sorry, that just a fact. You need to look at all variables and understand what you are doing not just sign the line next to payment.

That includes determining if the home is overpriced or undervalued. The last round of buyers with the ARM’s focused on payments and what they could afford to pay at that time. Then the ARM readjusted and the home value fell and now they can’t pay. If they had not bought an overpriced home by focusing on what they could “afford” at the time, they would be in much better shape today.

If they had bought a properly valued home or undervalued home, put 20% down, then if times get rough they can sell it even in a down market. And no, in 2005 almost NO homes were properly valued.

That’s why we don’t buy broken down fixer homes next to a highway for $500 sq/ft. If ever in doubt take a trip high into the mountains and look down. LA has no shortage of run down homes and fixers.