According to CNN,

“The housing market hasn’t bottomed out yet. For the third quarter, the closely-watched S&P Case-Shiller national home-price index fell 16.6%, and experts are predicting further declines. Of the top 100 markets, here are 10 with the worst forecasts.”

And out of those 10, 8 of them are in California. This isn’t news to the California housing bloggers, but it may be shocking news to most California homeowner/debtors. The numbers are staggering and things don’t look too good for the next few years. Here’s the data for these 10 areas that includes this year’s median price and the projected change change up to 2010.

1) Los Angeles, CA (LA/LongBeach/Glendale)

2008 median house price $375,340

2009 projected change -24.9%

2010 projected change -5.1%2) Stockton, CA

2008 median house price $248,050

2009 projected change -24.7%

2010 projected change -4.0%3) Riverside, CA

2008 median house price $256,540

2009 projected change -23.3%

2010 projected change -4.8%4) Miami, Miami Beach

2008 median house price $293,590

2009 projected change -22.8%

2010 projected change -6.4%5) Sacramento, CA

2008 median house price $225,140

2009 projected change -22.2%

2010 projected change -2.3%6) Santa Ana/Anaheim, CA

2008 median house price $532,810

2009 projected change -22.0%

2010 projected change -3.5%7) Fresno, CA

2008 median house price $257,170

2009 projected change -21.6%

2010 projected change -3.3%8. San Diego, CA

2008 median house price $412,490

2009 projected change -21.1%

2010 projected change -2.9%9) Bakersfield, CA

2008 median house price $227,270

2009 projected change -20.9%

2010 projected change -2.5%10) Washington, D.C.

2008 median house price $343,160

2009 projected change -19.9%

2010 projected change -5.7%Sources: National Association of Realtors; Moody’s Economy.com

I wonder how the realtors are going to spin this one given that the NAR is one of the sources. There will undoubtedly be some seemingly great deals out there in the next couple years, but I can’t really imagine anyone taking the “It’s a great time to buy” reason anymore. Sure prices have come down a lot since a couple years ago, but just because people are hoping the decline will stop doesn’t mean it will. With the dwindling economy, the chances of a quick recovery are slimmer than ever.

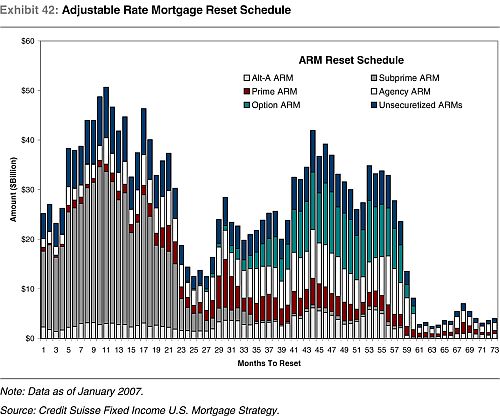

Don’t forget, we’re only about halfway through the exploding ARMs that were taken during the bubble. We’re only at #24 on the x-axis on the infamous Credit Suisse chart.

This is going to be a long and painful RE recovery for all of us. I wish I had something more uplifting to share, but this was the headline that I woke up to this morning. It’s not a pretty sight out there and the storm is going to get worse before it gets better, but I hope people have learned their lesson. In this season of love and joy, take time out to be thankful what you do have in your life. When times are tough it seems like everything sucks, but we are still far better off than many people in other parts of the world. May you and your family have a safe and happy holiday season!