According to CNN,

“The housing market hasn’t bottomed out yet. For the third quarter, the closely-watched S&P Case-Shiller national home-price index fell 16.6%, and experts are predicting further declines. Of the top 100 markets, here are 10 with the worst forecasts.”

And out of those 10, 8 of them are in California. This isn’t news to the California housing bloggers, but it may be shocking news to most California homeowner/debtors. The numbers are staggering and things don’t look too good for the next few years. Here’s the data for these 10 areas that includes this year’s median price and the projected change change up to 2010.

1) Los Angeles, CA (LA/LongBeach/Glendale)

2008 median house price $375,340

2009 projected change -24.9%

2010 projected change -5.1%2) Stockton, CA

2008 median house price $248,050

2009 projected change -24.7%

2010 projected change -4.0%3) Riverside, CA

2008 median house price $256,540

2009 projected change -23.3%

2010 projected change -4.8%4) Miami, Miami Beach

2008 median house price $293,590

2009 projected change -22.8%

2010 projected change -6.4%5) Sacramento, CA

2008 median house price $225,140

2009 projected change -22.2%

2010 projected change -2.3%6) Santa Ana/Anaheim, CA

2008 median house price $532,810

2009 projected change -22.0%

2010 projected change -3.5%7) Fresno, CA

2008 median house price $257,170

2009 projected change -21.6%

2010 projected change -3.3%8. San Diego, CA

2008 median house price $412,490

2009 projected change -21.1%

2010 projected change -2.9%9) Bakersfield, CA

2008 median house price $227,270

2009 projected change -20.9%

2010 projected change -2.5%10) Washington, D.C.

2008 median house price $343,160

2009 projected change -19.9%

2010 projected change -5.7%Sources: National Association of Realtors; Moody’s Economy.com

I wonder how the realtors are going to spin this one given that the NAR is one of the sources. There will undoubtedly be some seemingly great deals out there in the next couple years, but I can’t really imagine anyone taking the “It’s a great time to buy” reason anymore. Sure prices have come down a lot since a couple years ago, but just because people are hoping the decline will stop doesn’t mean it will. With the dwindling economy, the chances of a quick recovery are slimmer than ever.

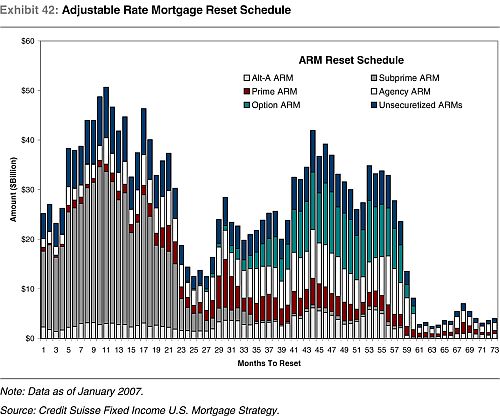

Don’t forget, we’re only about halfway through the exploding ARMs that were taken during the bubble. We’re only at #24 on the x-axis on the infamous Credit Suisse chart.

This is going to be a long and painful RE recovery for all of us. I wish I had something more uplifting to share, but this was the headline that I woke up to this morning. It’s not a pretty sight out there and the storm is going to get worse before it gets better, but I hope people have learned their lesson. In this season of love and joy, take time out to be thankful what you do have in your life. When times are tough it seems like everything sucks, but we are still far better off than many people in other parts of the world. May you and your family have a safe and happy holiday season!

Keep looking. My friend just bought an old house in Arcadia for $588k with 13k sq ft.

it’s good to be realistic about things, people who think the rebound is going to happen sooner than later could get themselves in trouble. good way to end the article!

RIP Saved by GRACE

Yes, RIP, this was a fine blog.

Did something happen to Grace? Where have the authors all gone?

San Marino so far so good. As waell as South Pasadena.

John, R E Appraiser

Prices dropping in Arcadia and So. Pasadena…may continue for a while

Arcadia houses are going to drop another 10%-15% with all the bad loans in the area.

The author of the blog has nothing to write about because the bubble has not really popped in arcadia and probably will not pop for a long while. As long as the overseas chinese buyers continue to buy arcadia homes, prices will march upwards. Now that the chinese government has made it difficult to own multiple homes in china, lots of chinese coming to the usa to buy. Look at housing prices in Vancouver and Sydney…lots of chinese buyers equals to inflated housing prices.

At least 3 or 4 realtors ring the doorbell in the summer or call and ask if I would like to sell my house in arcadia. Their clients are usually rich overseas chinese who want to send their kids to study in the US and gain easier entry to a US university. A chinese education is not worth much(unless it is from a elite university like Tsinghua) and competition is extremely difficult to get into an elite chinese university(they don’t care about extracurricular activities or that you are well rounded…just that you can score high on tests). The average chinese college graduate earns only a little more than a migrant worker in china. Getting accepted into a famous US university as an overases chinese student is also much more difficult than getting accepted as a US high school student.

I would not be surprised if housing prices in arcadia and other cities in the sgv double in the next 5 years.

Lots of chinese people think that housing is the best investment and will buy multiple houses. Any neighborhood in CA with over a 30% chinese population will have minimum $500,000 median house prices…

Starting to see some price deflating in San Marino, and So Pasadena area. Houses are on the market longer,like 60 to 120 days.

Now that we have a benefit of hindsight (since this was first posted in 2008), have the 2010 projections born out? According to the last Census, Arcadia’s population only grew by 3000 in the last 10 years (+6%) and the “they are not making more land” argument does not seem to have much teeth – it would only adds pressure if there is a really big influx. 6% seems rather mild.

The blog is dead because Arcadia bubble was never there. All the Chinese foreigners are out bidding every houses that are on the market. RIP GRACE for trying!

@kenny: Sounds like a dream of every homeowner (at least those who’s trying to sell). Too bad we can’t find enough foreigners to prop up home prices of every neighborhood in the country. Many wish that SOMEBODY please start buying in their neck of the woods!

If Arcadia is a bubble, then what is Vancouver? Lots of money flowing out of China right now as property prices have started to level out or fall in the “hot” markets. SGV could very well see much higher prices for homes.

Things are picking up!!! Were back!