The housing crisis we are facing today is without precedent. Although there have been many housing bubbles in the past, the mess we got ourselves into this time will go into the history books as giant Wall Street financial institutions go from billion-dollar companies to being worth… nothing.

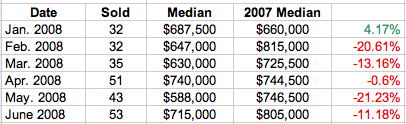

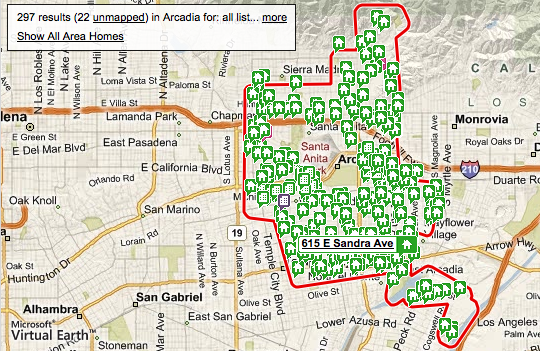

I have said several times that as potential home buyers today, now, is the time to save your cash. Sure, if you’re looking into the Inland Empire or Antelope Valley, there are plenty of unbelievable deals out there. But here, the San Gabriel Valley, has some time to go before prices correct themselves.

Now that the hype is over, people are starting to realize that million dollar plus McMansions are expensive to maintain and $700,000 for a fixer-upper is a horrible deal. People are also starting to realize that Arcadia is no San Marino and actually more comparable to Temple City (not saying that TC is bad).

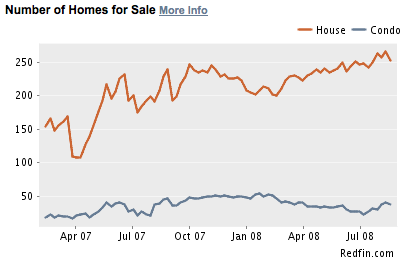

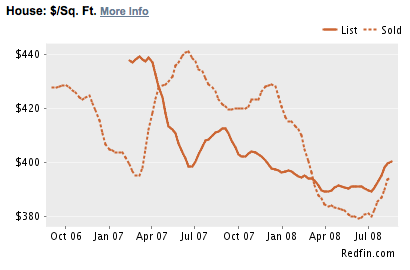

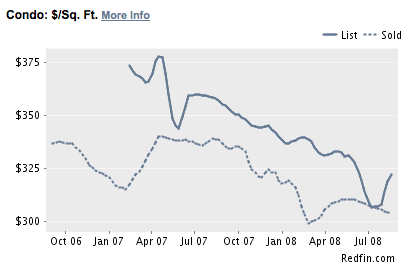

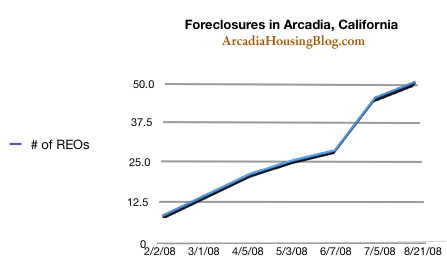

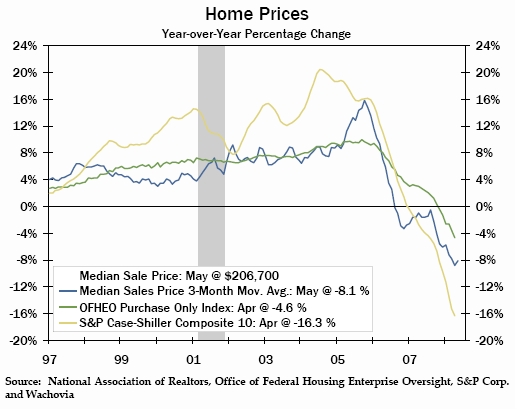

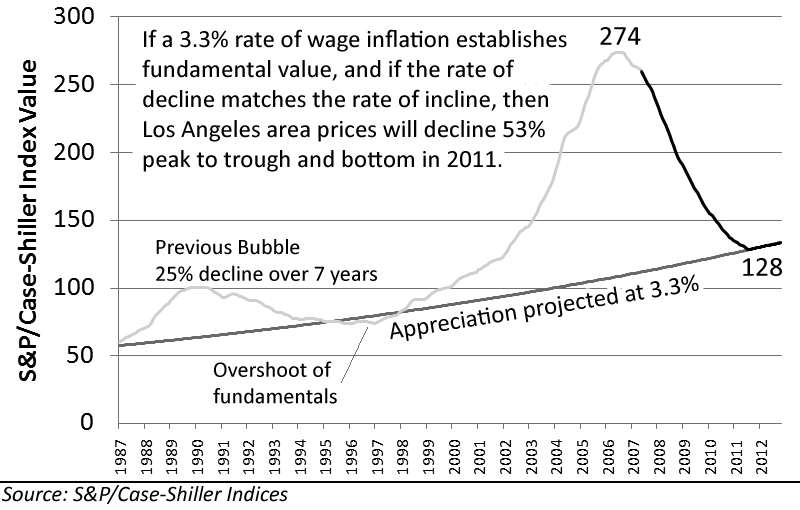

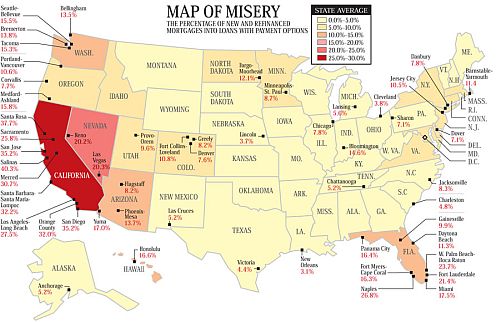

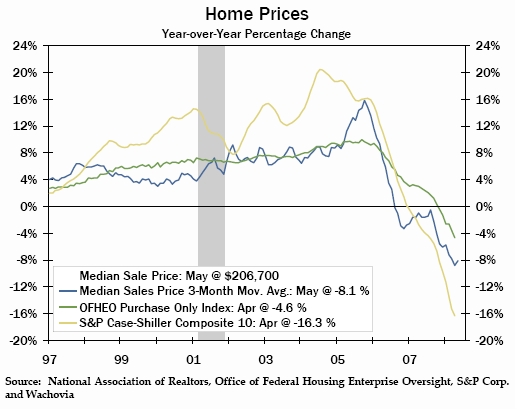

No matter where you look, everything points to more declines in home prices. Here are figures from 3 major trackersL

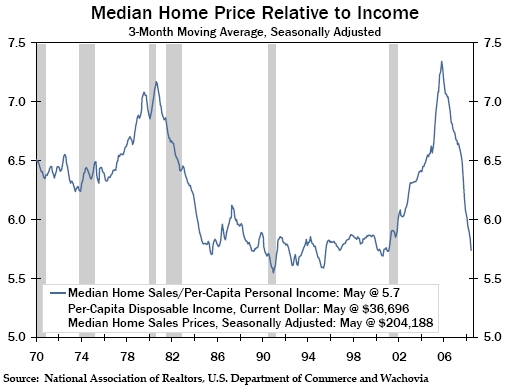

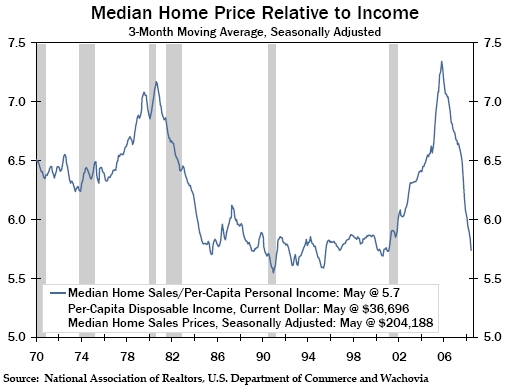

Not surprisingly, home prices had skyrocketed beyond relative income levels:

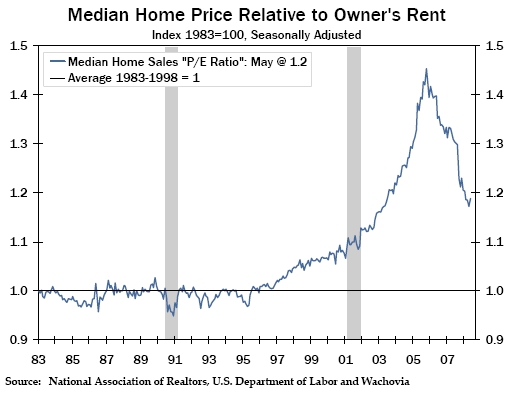

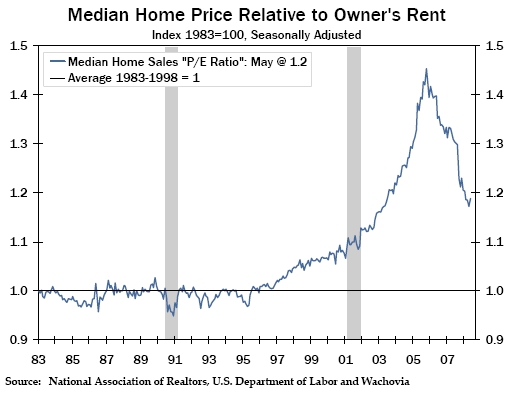

In a normal market, people buy houses because it is better than paying rent. During a bubble, it is much cheaper to rent than to own. It is no different in Arcadia, Temple City, Monrovia and Pasadena. Today, it is a lot cheaper to rent in these cities because home prices are out of line with fundementals. There was a reason that $700k PUDs in Arcadia were selling for only $400k just 5-6 years ago.

I know too many people in the Rowland Heights, Diamond Bar, Yorba Linda and even Irvine regions that argued prices in their area wouldn’t drop much due to ‘stellar’ schools, excellent location and a central hub for Asian immigrants.

Two years later those same people are split into 2 groups:

Group 1: They didn’t buy but claim that NOW is the best time to purchase before prices skyrocket again. (?!?)

Group 2: This group bought and feel that it’s necessary to justify their purchase because it was “the home” and they got a great deal on it (despite being underwater on their loan).

Both groups now say that it is ok to buy if youplan to hold on for 5 years

Does this sound like denial to you? Although I know that everyone is on the lookout for their dream property, buying a home is one of the biggest financial decisions someone will make in their lifetime. There is very little room for choices based on emotional attachment or denial of fact. I believe that everyone should work hard to buy a home one day.

Unfortunately, as an Arcadian renter, today is not it.

*******************

Calling the “bottom” isn’t that important to me because when the time to buy is here, there’s no way you can miss it. Just compare the price relative to your household income and figure out the difference between the cost to rent versus owning. Trust me, if you sit down and run the numbers, the decision will be easy. But if you insist, here is my call:

November 2010

Sure, 2009 will be a dismal year with plenty of false hope. Wait until after the Summer of 2010 because that’s when the reality of real estate will sink in: homes, unlike stocks, are illiquid assets and make horrible investments. But they are great for growing families and individuals wanting to settle into one location.