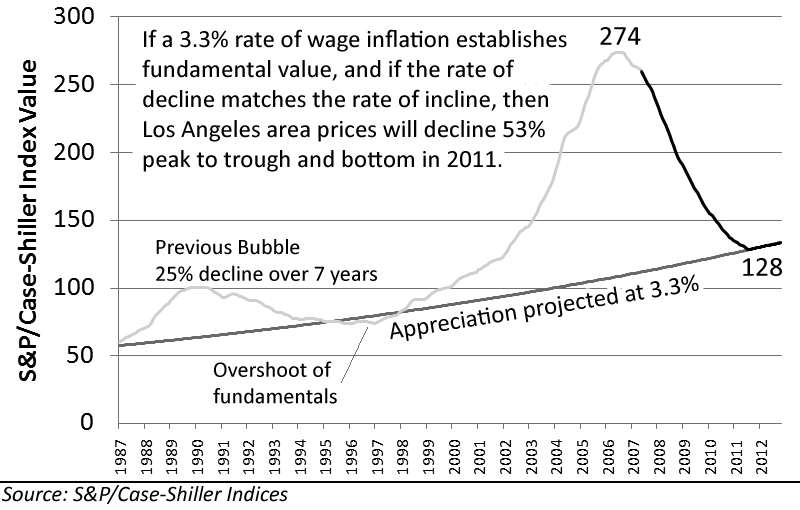

Most people give me a crazed look when I tell them home prices in Arcadia will drop another 25-30% over the next 3 years. Why is that so hard to believe when values doubled and nearly tripled over the course of 4 years? A housing bubble consists of 3 points: a peak and two bottoms.

Have we hit the second bottom yet?

Over the course of this housing downturn, I’ve personally met friends and associates who are all at different stages of the home buying process:

1) Renter Savers

These people may or may not have money for a downpayment. They understand how bad the market is and rent because it’s cheaper. This group of renters are living below their means and save a good portion of their monthly income.

2) The Clueless

These guys have very little money and absolutely clueless regarding what it takes to buy a home. Therefore, they rent and have no idea as to how bad this housing crisis is because it seemingly doesn’t affect them.

3) Would-be Knife Catchers

I am most worried about this group of friends. They are just starting to realize how much money homeowners made off real estate over the last 5 years and are eager to jump into the market. They view real estate as a great investment and renting as a “waste of money”. Many of them are excited over all the REO auctions popping up throughout Southern California and are eager to land a smashing deal.

In addition, these individuals all seem to know a Realtor or prominent financial guru who encourages them to buy now because we’ve hit bottom. I tell them we have a few more years of double digit price reductions to go and they shrug me off.

For those in Group 1, they’re in a good position. After this whole crisis blows over, those with cash-on-hand will have no shortage of affordable homes to choose from. Even if interest rates skyrocket, home prices will fall even further and a sizable downpayment increases your buying power.

For Group 2 folks, I’ll sum up the housing bubble in 7 points:

Late 1990’s – The tech boom crashes and everyone wants a safe investment: Real estate!

2000 thru 2003 – Fed lowers interest rates and increases home buying.

2003 – Sales weaken so lenders push for more interest-only (IO) and adjustable rate mortgages (ARMs).

2003 thru 2005 – Housing prices double and nearly triple throughout the country. East and West coasts become investment flipping hot spots and we get:

- Media hype

- A buying frenzy

- Investors flood the market

- Developers overbuild

- …and 1 out of ever 4 adults becomes a real estate agent. [sarcasm]

2005 thru 2006 – Mainstream media acknowledges that we’re in a “bubble” but the Feds, Wall Street and National Association of Realtors is resistant to the news.

2007 – Show’s over as the secondary lending market collapses overnight and eventually giants like Countrywide, Washington Mutual and Citibank get hammered. Sales volume and prices begin dropping at record levels.

2008 – We see no stabilization in prices and definitely no bottom in site. The crisis makes it way into Los Angeles and all but a handful of cities show resistance to the trend. Sorry, Arcadia isn’t one of them.

You know what’s funny about your post? Even if prices in Arcadia come down another 25%, median prices will still be north of $600K and people will still complain that they can’t come up with $120K in down payment and afford a $3K mortgage and that prices NEED to come down more so that they can buy in Arcadia like they richly deserve it.

Personally I think RE prices in Arcadia and other SGV cities will come down more than 25% over the next three years, but I guess we’ll see. I’m a rent-saver buyer so I’ll jump in when it costs about the same to buy or rent a comparable house. Prices have come down a bit, but renting is much much cheaper than buying. In this day and age, two working professionals should be able to plunk down $120k and afford $3k/mortgage payment without too much trouble.

If people can’t put at least 20% down and afford the 30-yr fixed rate monthly payments, then they have no business in buying…regardless if house prices are $400k, $600k or $900k.

The looming foreclosure of Ed McMahon’s Bel Air home is the epitome of what’s wrong with the attitude of so many in America today.

They spend every dime they have and use the home as an ATM to bail themselves out. While sad McMahon squandered millions and still blames others for his bad decisions.

A 25% decline in RE while possible I don’t think will happen; however, prices will declines in “real” terms. Meaning after inflation, so if a home is worth $500k today it will still be worth $500k in say 8yrs. I’ve seen this happen in resort areas like Lake Arrowhead and Palm Springs so anything is possible.

I think your downslope is too slow and too slight. My guess is that it will go to 63 before 2012, violating the trend line based upon the previous two lows. This is simply explained by noting that the defaults and foreclosures corresponding to those lows were nominally one fifth of the current rates.

Additionally, the subprime mortgages have yet to hit their peak reset (another 4 or 5 months?) and then we wait a year or so for the option ARMs to begin their climb to their peak in about 2 years. By that time the rest of the country will have had it with bailing out the Really Stupid People in California, Florida, Arizona, Nevada. ‘Had it’ may include the possibility that we’re all broke, unemployed and on welfare and foodstamps too. (I sure hope these Democrats don’t decide our IRA’s and 401k’s are low-hanging ripe fruit — though Friday implies a shrivelled future there).

Any expectation that a bottom has been reached before housing’s median drops to a usual multiple of median income will be dashed again and again.

Today’s knife catchers (anyone who buys today at more than 20% to 30% of the most recent high price) will be characterized as just more bubble people in that sometime future history.

If compared to the previous two bubbles, I’d have to agree that this housing decline will be much faster and harder. It is unfortunate that many would-be knife catchers are basing their purchase on false hopes and emotions rather than fundemental values and affordability.

It was only 5 years ago when many of the $700k homes/PUDs you see listed today were going for only $350-400k. Now that speculation and liar loans are gone, prices will decline and flatten out as Johnny mentioned early.