Today’s new listing is a property that, for the right price, would be a decent home. Although it backs up against Michillinda, you get decent living space, a 10,400sf lot and what looks like a floor plan that can be worked with. Of course, the asking price of $788,000 rubbish….

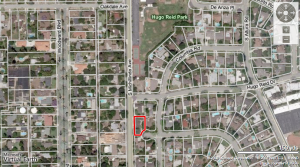

1151 Drake Rd.

Arcadia, CA 91007

Price: $788,000 ($485/sf)

- Beds: 3

- Baths: 2

- Sq. Ft.: 1,626

- Lot Size: 10,400 Sq. Ft.

Unlike most properties that slowly appreciated in value between 1996 and 2003, this one got an early start on the bubble:

Sales History

Sep. 1998 $310,000 ($190/sf)

Apr. 2000 $400,000 ($246/sf)

July 2002 $486,000 ($299/sf)

The last 2 owners made approximately $90,000 after two years of ownership. The current seller is aiming for a $302,000 profit after just 6 years! If this was 2006, I would have no doubt that this home would sell between $800 – 900k. Well, that is no longer the case and a $485/sf asking price for this 57 year old home unrealistic.

Straightline appreciation from 2002 gives us the following values:

3% $580,309 ($357/sf)

4% $614,945 ($378/sf)

5% $651,286 ($401/sf)

6% $689,400 ($424/sf)

My suggestion? List the property at $600k and allow the knife catchers or sideliners bid up the finals sales price. This is a sure way to get a quick sale and still walk away with a sizable profit.

What a great advice! But, it is difficult to give the property away, thinking just last year it was selling for $900K.

For low volume trade or illiquid asset trade, the best time to sell is when there is a buying frenzy. And, there is no buying frenzy on real estate anywhere.

Any owner of today just have to recognize where the substantial big and ask spread are, and willing to hit the bid when it appears.

If not, the seller will be just chasing the market down, and down….