For those who enjoy the Victorian style homes, here’s a special one; a 4,693sf single story property sitting on .41 acres. It was remodeled in 2002 and it looks to be in great condition inside and out.

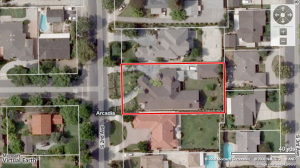

1910 S 2nd Ave.

Arcadia, CA 91006

Price: $1,380,000 ($294/sf)

- Beds: 4

- Baths: 4

- Sq. Ft.: 4,693

- Lot Size: 0.41 Acres

From the listing:

This is a lucky house, owner has moved to a multi-million dollar home. Price right for quick sale.

Price right, you say? Although this home was upgraded in 2002, is it enough to warrant a $500,000 premium over the 2002 purchase price? Is the seller moving into a multi-million dollar home because some knife catcher is going to pay for it?

Sales History

Feb. 1989 $1,100,000 ($234/sf)

May 1992 $970,000 ($206/sf)

July 1995 $777,000 ($165/sf)

Apr. 2002 $850,000 ($181/sf)

This is exactly why you never want to buy during the peak of a bubble. As we can see here, the 1989 buyer would have lost money on his home even after 13 years of ownership! This is why I believe renting, even at the cost of inconvenience (i.e. school, children, relocation, ect), is worth it when home prices are highly inflated.

I know family members who decided not to sell their home during the peak of the bubble because it was “troublesome” to move everything and rent a smaller place. Now that prices are declining, they are regretting the decision to not cash in on $600k of pure equity.

On the other hand, I also know people who bought during the last 2 years because prices have “softened” and they would be living in it for 5-7 years. Of course, they are now freaking out because it’s very possible their home would be underwater that entire time… or even longer.

But I digress. Here is my evaluation:

After 6 years of ownership…

3% $1,014,944 ($216/sf)

4% $1,075,521 ($229/sf)

5% $1,139,081 ($243/sf)

6% $1,205,741 ($257/sf)Currently listing for $1,380,000 ($294/sf)

Based on the 6% figure, would you rent if it could save you $180,000 over the next 2 years?

Wow. This still looks to be high — but according to your numbers it may only be over priced by a few $100K. I know that is real money — but its also not the hyper inflation I am used to seeing in house prices.

Great site, keep up the good work!