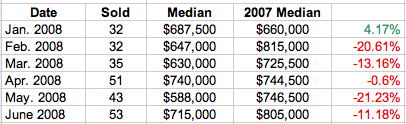

The June 2008 housing numbers are in so I’ll leave these up over the weekend. We’ve gone ahead and compiled the figures for the entire first half of 2008. I would love to here your thoughts!

Arcadia Homes Sales Data

Something tells me that this trend will continue for the rest of the year. This data shows that the “high-end” homes aren’t selling like they did during the peak of the bubble. And you know why? It’s because anybody who could afford the 20-30% downpayment on a million-dollar plus property is probably smart enough to know that real estate appreciation is dead for the next several years and they are better off investing that cash.

Have you heard about Wachovia and their whopping $8.8 billion loss due to the housing and credit crisis? That is no small change folks. Our friends on Wall Street are currently trading assets at pennies to the dollar because what used to be a hot item (i.e. real estate) is now considered the worst investment anybody could hold.

Of course, you already know this. Housing was never meant to be commonly traded as a liquid asset and it never will (except during a bubble!). But tell that to the 200+ sellers currently on the market and you’ll sure to be stoned.

Wall Street’s not worried. Wait and see, we’ll have yet another gov’t bailout.

Yea, I know what you mean. I just don’t think a $25-100 billion bail-out is enough to stop the bleeding.

Remember, this problem is no longer isolated to the U.S. housing market. There is an expected $1+ trillion in complex derivatives out that even Wall Street does not have a grasp on.

Trust funds, pension plans and thousands of jobs are being affected by this crisis. This bail-out, if it gets passed, will do more to help Wall Street’s problems than to actually assist homeowners or buyers.

I know what you mean about “getting stoned” by sellers. People get very emotional about their decision to buy a house. I once lost a business deal b/c I pointed to the client he had bought at the height of the market in 06′ paying $650K for a 2 bedroom, 1200 sq. ft. condo in Pasadena (The mix use bldg. on corner of Lake and Cordova). It looks like Congress will soon pass the bailout provisions without GW’s veto. Funny how the government can act so swiftly when it comes to bailing out banks and large corporation from collapsing.

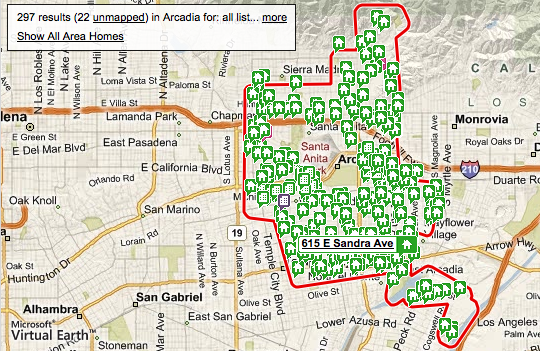

Just a question about the number of Arcadia listings. Is the current number a significant jump from previous months? I recall when Arcadian was posting the number of listings each month that the number didn’t seem to change much. However the Redfin picture looks much more cluttered with little green houses than I remember.

Also, is there an easy way to get a true number or an estimate of the number of foreclosures not on the market but sitting vacant?

Hi Arc,

Redfin shows almost 300 active listings while ZipRealty (which we use) reports ~230. Standing inventory has actually decreased since January; which is understandable since more homes are being sold or taken off the market.

You can check active REO listing here: http://www.foreclosure.com/search.html?ci=arcadia&st=ca&cno=037&z=&tab=f

I do not think it is 100% complete… but not much is these days due to everyone having their own method of gathering data.

Hi

Has anyone ever signed up the foreclosure.com to see the details of the foreclosed homes? Is it worth for the money? How about the free 7-day trial? Your advice will be appreciated.

If possible, I would like to see a discussion thread on the implications of passed housing bailout bill by the congress and senate on the current housing market.

“implications of passed housing bailout bill”

The bill is a joke. It’s a bailout for FRE and FNM which will help banks and not the individual homeowner. The media glosses over that little detail.

A Princeton economist said look for So Cal RE to drop to 2000 levels before this is all over.

This is a very complex issue. And if the government is going to provide any financial aid it will be directed at the banks to save our financial system. The government does not think at an individual level nor do they care about the guy who overpaid for his home.

The core problem is that the government did not have enough oversight on the banking industry. They let banks commit fraud when they packaged junk (high risk) home loans into AAA Quality Bonds. That was the lie. If they had labeled the bonds accordingly (some would be almost junk grade) they would not have sold as fast and the demand would have been lower and banks would not have given out stupid loans. Without the stupid loans the homes would have never bubbled.

That is the core issue. The banks committed fraud, plain and simple. It is the falling prices that happened to trigger the bad loans going bad. But if they had true AAA quality loans with 20% down, you would see a lot fewer people walking away. Instead they gave loans for 125% of the value to people who could not afford them. That kind of buyer is going to default.

The fix? Well you can’t give more money to the idiot buyers who could not afford the home in the first place. That is like putting a band-aid on a broken leg.

The fear is keeping the dollar strong. So the government might try something to help lessen the risk on the low quality bonds. A lot of US investors bought these “AAA High Quality” bonds on the assumption they were SAFE. But they were lied to by banks. So the bailout may likely be put in place to protect some of these people. It may appear that they are “protecting the banks” but in reality they are protecting the people who have invested in banks. (Retirement funds, etc.)

In my opinion it’s a positive thing that home prices are falling. I think they need to go back to 2000 levels or less. Cheap housing is the best thing for an economy. It allow people to buy a home that fits their income, which in turn increases the sales of other consumable items. Sure people who bought in the past 5 years may have negative equity, but the same can be said for stocks, cars, and many other items. But you can’t create a policy to protect the few people who bought at the wrong time. There was no bailout for stock investors who bought in the NASDAQ in 2000. It’s a risk you take, so just let the housing market fall and when the low price point is hit the homes will sell again. It’s that simple.

So I hope any bailout is not used for dumb consumers. Nor should any bank that is bailed out be allow to operate again in the future. It should be a FDIC takeover, and when the loans are paid back so is the government. Also, the people responsible for packing junk as AAA quality need a few years in jail. (Seriously, it is white collar crime.)

Remember, the US Government needs to protect the value of a dollar. If the currency collapses we will be in a world of hurt. (And that can happen if other countries consider the US Dollar as unsafe and pull there money out of our banks.) So I think this is the governments plan, at least I hope so.

Sean, i agree with most of what you say but right not the dollar is very weak and getting weaker by the month. in the old days fear meant higher dollar and gold, not anymore.

As for investors in these junk bonds many were foreign, like in Japan, Australia and of course China. Individual participation in these bonds is nonexistant as they are usually sold in lots of $10M. So far about $400B has been written off, lood for another $600B before we call it a day.

I think a 6-8yr drop is in the cards, or about 25-40% in SoCa. Tight lending and higher rates are going to hold back any appreciation for years.

I did not say the dollar is ‘very weak’ weak or ‘getting weaker by the month’. I double checked and didn’t see that in my post.

I did say that the government wants to protect the value of the dollar.

But you bring up a great point! As of right now the USD has lost a lot of value compared to the Euro. And I do think we need to worry about the value of the USDollar.

Here is the yahoo chart, it does not look good to me. What do you think of this chart?

finance.yahoo.com/q/bc?s=USDEUR=X&t=5y&l=on&z=m&q=l&c=

well.. reading through some of the fine print on the new housing bill…

Debt to Income Ratio of 31 percent… You need 2 years of w-2 to prove this out….

Take another 20 to 30% off home prices…

I believe the house prices will collapse much quickly than 6-8 years. Already now most banks require the old standard 20% down, paycheck stubs, bank statements, and credit card statements. Also most banks will only issue 30 year fixed mortgage.

$400,000 loan, and 20% down, $80K, equals $480,000 house.

$400,000 at 6.5% interest 30 year fixed, is about $2300 a month. Add $480 a month of property tax dues. Total liability is $2780.

In order to qualify for $2300 a month mortgage it needs to be between 28% to 36% of your gross monthly income. Most banks are very conservative at 28%. So, at 28%, equals, yearly salary of $98,500.

How many persons make about $100K a year?? Where I work 80% of the employees make about $65K to $75K.

The run-up of house prices were mostly due to very low teaser interest only rates, with no income documentations, and 100% of LTV. It was nothing but greed and reckless lending.

MattCURE,

You are assuming that first time buyers will be buying houses north of $500K. Most of the people who buy in Arcadia or expenseive cities like South Pas will be buyers moving up from a current house and will be rolling equity from their current home. Most families have dual incomes today. Unless you have very high income, it’s unlikely a single earner will be able to afford a SFH in Arcadia. It’s just the reality of today.

Looks like the housing bailout is final. Prudent taxpayers who did not participate in the housing fever will now have to foot the bill to save the day. I can’t help but to feel cheated by Congress and the President. Now this bill will become law, I hope the final version will atleast prevent bailout of speculators/flippers and people who used/abused their homes as ATMs.

Does refinancing with the new bailout housing bill turn your non-recourse loan (assuming one didn’t refinance or HELOC) into a recourse loan in California? I wonder who wants to refinance if they are underwater since any future profit will go to FHA.

I had done the similar calcutation and did a little experiment with my bank. I said that I would like to buy a property valued 1.35 M with excellent credit (800+) and income of $200K with paper. The bank asked for proof of 55% of the value of the property in my asset to allow me to put 47% down with 53% mortgage. The 53% comes from the max of jumbo loan ($729,000).

I don’t know who can buy a property over 1 M ($911,250, 20% down + $729,000 max Jumbo loan) now? Unless your current house has high equality value and you can sell it before you buy the new one. You also need to have very high income, like the top 5% of the current Arcadins do to afford the mortgage.