| Asking Price | $1,698,800 | ::: | Sq-ft | 3,504 |

| Purchased Price | $1,500,000 | ::: | Lot Size | 0.27 acres |

| Purchased Date | 01/07/2005 | ::: | Beds | 6 |

| Days on Redfin | 4 | ::: | Baths | 4 |

| $/Sq-ft | $485 | ::: | Year Built | 1948 |

| 20% Downpayment | $339,760 | ::: | Area | Highlands |

| Income Required | $424,700/yr | ::: | Type | SFR |

| Est. Payment* | $8,589/month | ::: | MLS# | A08056374 |

*Estimated monthly payment assume 20% down, 30-yr fixed @ 6.50%

Many often wonder if the high end of the market is immune from the market downturn. So far, subprime has done its share of damage to California and as expected, it hasn’t affected certain markets much. Subprime isn’t really a problem in Arcadia. In markets such as these, Alt-A & even prime ARMs (as well as other option loans) are the thorns in this area. Today’s property is a REO up in the Highlands.

Purchase History

Date 01/07/2005

$1,500,000

Date 01/15/2003

$700,000

Asking Price April 2008

1,698,800

I see activity on both 3/14/05 (2 months after purchase) and 8/17/06 (1 1/2 years from purchase), but the price information is only listed as N/A. For the asking price to be $198,800 above the previous sale price the seller must have pulled some serious cash out from a HELOC since January of 2005. There were some major renovations made to the property which probably means it was a failed flip.

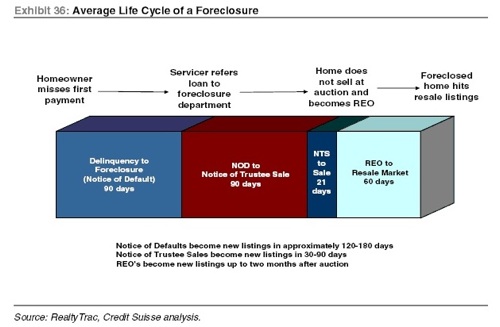

If the sellers used a 2/28 ARM, the loan would have reset in Q1 of 2007. That’s precisely when the credit crunch started to rear its ugly head and the flippers probably stopped paying a few months thereafter. The foreclosure process can take a long time. It can take anywhere from 9 months to a year from the time the owner stops paying their mortgage payment till the day the property gets re-listed for sale by the bank.

Since both high and low end markets experienced enormous gains during the boom due to unjustified speculation, both will likely incur a similar correction back to a sustainable market. The participation in HELOC abuse is not contained within certain market segments. Condominium and townhome owners were just as eager to tape into their equity as SFR owners. This was evident in the widespread use of “free money” during recent years as homedebtors were enabled by greedy bankers to refinance themselves into oblivion.

The bank will lose money if the cannot sell the property for what they paid a couple years ago. With home prices tumbling all across the nation, I find it hard to believe they can find a sucker to buy this for $1.7MM. The sale in 2003 went for just $700,000. That seller made out with a whopping 47%/yr appreciation when the property was sold for $1.5MM 2 years later. Now if that isn’t a massive bubble, I don’t know what is.

Since 2003 was already well into the bubble, I would venture to say that this property would drop back down to 2003-2004 prices in a few years when the correction draws close to the bottom. It’s a nice house, but not $1.7MM nice.

This property will sit in the inventory at this price for years. A knife catcher may try at $1-1.2M.

Carrying costs — about $20k/year just to cover taxes and a little upkeep.

I wish I could say this in private: be careful in posting speculative information. From my limited research, most of what you said about this property is not correct. I like your blog very much and I don’t want to see you getting into trouble.

Zen:

I wonder if you could share what you found from your limited research about this property? After all, this is a real estate blog where we all try to share information and educated opinion.

Thanks,

George

Our research of public records (e.g. redin, pub records) show this property to be an REO with several un-detailed public record entries. Based on that information in addition to its listing record, we’re providing a theoretical scenario of a distressed homeowner.

Can public records be wrong? Most definitely. You can fill us in on the discrepancies at thearcadian[at]arcadiahousingblog.com. We’ll be more than happy to revise any posting if new information comes up.

Unless we start digging up private and personal information, we can never be 100% accurate of each listing’s history.

I’m glad you enjoy the blog and truly appreciate you looking out for us. This is in fact an REO so there’s nothing speculative about that. If you’re referring to my 2/28 ARM flipper scenario, that is my theory on what happened. Echoing the thoughts of TheArcadian, if you have insider information from your research that refutes my theories above please let me know and I can retract/revise my statements.

Again, another strange weekend…

but, I will go back to my breaking point theory again. As I walked and drove by many parts of Arcadia, I tried to take in the community as a whole.

The common word of the day, is that we have hit the bottom. I tried to say no not really, because A. Nobody can qualify for a loan, and B. We have way too much inventory. Most of the people just shrugged me off as some cook.

However, I would like to add C. to the equasion, and that is the end of cheap oil, and massive inflation that is occurring right now. Huh, what? Yes, this little “sub-prime” crisis is going to accelerate with the Alt-A implosion etc, but (pun intended) the part of the model that is going to add the gas to the fire is Higher gas prices and higher food prices.

Think I am crazy, read http://www2.nysun.com/article/74994

Thoughts?

I’ve accepted the fact that homedebtors, their realtors and the NAR are going to cry bottom many, many times before we actually get there and have almost given up on voicing my views because they don’t listen anyways. What will happen will occur regardless of what I said (or don’t say) so I just keep to myself now.

As for the rising oil prices scenario, I’m in complete agreement that it will affect many, if not all, facets of our lives – housing included. We bought a bag of rice this past weekend that used to cost $12.99 (we paid $20.99 yesterday). The crushing weight of the weak economy will further depress home prices as people struggle to get by. The subprime problems will seem like a small deal if the dollar continues to tank and commodity prices skyrocket.

We’re in it for a rough one. Put on your seatbelts and hang on to that cash.