I recently had the opportunity to meet with 3 individuals who “specialize” in real estate investments. I say this with a sarcastic tone because these guys started flipping properties in 2003 and rode the real estate bubble to success. With all the news lately regarding the drop in real estate prices, increase in foreclosures and other record breaking data, these real estate professionals claimed that we’ll hit rock-bottom this Fall and it’ll be time to jump in again. Since I was the youngest in the meeting, my attempts to explain that we are at least 2 years away from bottoming out were dismissed as ludicrous.

There is no doubt that there will be plenty of knife catchers out there and even many self proclaimed real estate gurus will be victims. What many people don’t realize is that unlike stocks, real estate is not a very liquid asset. It takes several years for values to run up and equally as long to crash.

Let’s take Wall Street’s recent poster child for failure as an example. Countrywide Home Loans’ stock soared alongside our current housing bubble. It went from $13 in 2003 and peaked at $45 in early 2007.

As soon at the subprime lending market tanked, it took only 6 months for Countrywide’s stock price to hit $8. It has since bottomed out around $4 before Bank of America decided to bail… sorry, I meant buy them out. Gosh, that sounds awfully familiar.

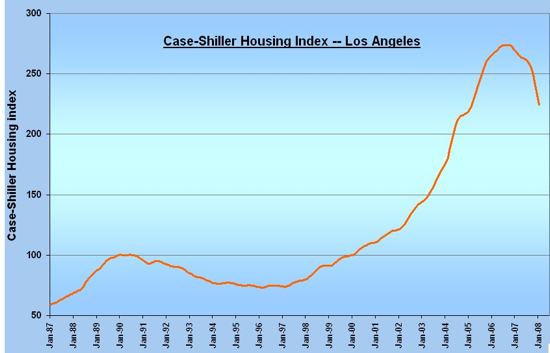

Unfortunately for us, real estate transactions take 30 days or longer to complete so data is always lagging behind. Because this is the case, historical figures and graphs from providers such as DataQuick and the Case-Shiller Housing Index are valuable resources (below).

According to this data, Los Angeles home prices peaked around mid-2006 and it has been dropping for over 18 months now (20 if you count February and March). If you look at home prices between 1995 and 1997, you will notice that the market bottomed-out and stayed that way for approximately 2 and a half years.

I keep hearing that us Arcadians now have this psychological barrier when it comes to home prices and the days of desirable $200-400k homes or condos are long gone. If you believe this then be my guest and purchase a home this Summer.

As for me, history says that buying in these market conditions is equivalent to catching a falling knife: the pain will come fast and hard as your neighbor’s REO wipes out any equity left in your home.

This post inspired by my clueless associates and Patrick.net’s Don’t Catch a Falling Knife.

I too have been hopeful that the large decreases in house prices which exist in many newer areas will finally reach Arcadia. And I know they did in the early 1990s cycle. But I don’t see any signs of it this time. Pointing out the extreme prices of Arcadia houses loses its credibility eventually without indication that anything will change. Its been many months now. Where is the quality Arcadia home for sale at less than 2006 prices?

House Hunter,

I think SBG has done a great job at profiling several Arcadia properties that reflect the changing landscape of our local market. As stated in my post, we still have a lot of time before seeing 40-50% off peak property values.

But 10, 20 or maybe 30%? It’s already happening.

Take a look at the following profile we did back in January: Golden McNugget

This home sold for $985,000 in 2004 and got flipped for $1,250,000 in 2006. SBG had stated that a “fair offer” on this house would have to be under $1,064,000.

According to Redfin, this McMansion went for $970,000 last month. That’s 22.4% off the 2006 sale price and even a bit lower than 2004’s selling price.

I think your friends also bought Cisco when it was $100 on its way to $20. I agree with you that RE is dead as an investment for the next 10 years. RE will revert to being primarily a place to live and secondarily as an investment. I’m looking to buy a house, don’t laugh, even at these levels. The reason is that I’m pulling equity out of my existing house and rolling it into the new house. If prices go down another 20%, then the house I’m buying and the one I’m selling will roughly go down by the same amount. True, I’ll have to pay more RE taxes with the higher price, but I’ll trade that to find a house that I like. Selling my current house and renting for a few years is not appealing to me. I would have to pay tax on about $500K in cap gain on my current home, loose the ability to itemize my taxes and I hate having to deal with a landlord

You don’t have to look far in ANY community to find quality homes selling at less than 2006 prices. The Arcadian is right – it is happening already, and will continue. The perfect recipe for this situation is someone who bought with a 2/28 or 3/27 fixed adjustable a la Wells Fargo or WaMu, circa 2005-2006. Trust me, there are PLENTY of people in Arcadia (and throughout the southland) that used these mortgage products to buy beautiful homes. Problem is, now they can’t refi since many are under water OR they don’t have the income that they lied about back when those exotics were initiated.

And wow, SBG – I guess I can call myself a “specialist” too, given the credentials your “professional” pals possess. 🙂

Unlike those pros (ha) I won’t be calling a bottom this year or next.

The relatively modest sized “Golden McNugget” on a tiny lot at nearly $1mm is hardly grounds for hope. I’ll believe that there is a price decline in Arcadia when I see blog entries pointing out a house at a good price rather than just entries pointing out the ridiculous prices being asked. I have been waiting for the Arcadia price decline for 18 months. I sold my house in the Oaks years ago and would like to buy one like it. Zillow shows my old house continuing to increase in value. Currently at its all time high. La Canada was up 5% for 2007. I know houses in some other locations are way down. Don’t care. Doesn’t help.

You know, there IS a remedy for overleveraged HOMES (I emphasize this because there ARE people that love and WILL love their family home(bought in 2005-2007), even if and when the neighbor’s house sells for 20-50% less.)

You can use creative affordability strategies to save MORE INTEREST on the backend of your loan than you paid more on the purchase price.

You can read about it (and get more info) in this blog post.

House hunter, I grew up in the Oaks. I understand why you’re looking for a bargain there. It’s a great neighborhood.

What $ amount are you looking for? You initially said “less than 2006 prices” but now I am assuming from your second post that you mean far below those numbers.

I can only provide hope in the way of what is happening in my area. Even with median home prices currently in my neighborhood at over 1mm, we are seeing drops to 2005 pricing on what I would deem “quality” homes. They are limited, but from what I can see coming down the pike, there will be many more to choose from in the near future.

No city, no area will be immune. By the way I would never put my trust in Zillow. For example, a property I recently sold in another area is listed with an incorrect sales price – over 800K off.

You mention La Canada. Where did you get the 5% number for 2007? Here’s some 2008 median info. Dataquick shows La Canada March 2008 versus March 2007 median:

LA CANADA FLINTRIDGE 10 $1,055,000 $1,734,000 -39.16%

That’s a small sample – 10 homes sold. But 39% down is not exactly a small drop in median price.

http://www.dqnews.com/Charts/Monthly-Charts/CA-City-Charts/ZIPCAR.aspx

the link with the info. I referenced

I wish it were so. Median house prices can be badly skewed by the types of houses listing and selling. The grossly misleading median shown for a insignificant sample of 10 in La Canada demonstrates the problem, which in this case is just sample variation. Zillow has a complex computer sysytem which takes all available reported data into account. The major problems are occasional unaccountable errors as you mention, data trailing, and unique situations. Across the board however, Zillow provides a great deal of useful information. I have been following 6 houses in La Canada for 18 months, Zillow has them all at all time highs, and this appears to me to be probably correct.

Do you feel that there will be no downward pressure whatsoever (based on current economic conditions, rates, credit tightening, and comps) on those 6 houses you are interested in?

I can think of a few reasons why that might be the case.

puckhead,

In your situation, it would makes sense to just roll over the equity than to pay capital gains on that $500k.

Because you are a move-up buyer, then the decline of home values will affect you either way. That is unless you rent and wait. But then you’re stuck with a big tax bill and the declining value of the dollar.

That all depends what you consider “a good price” because for me, that’s rock bottom prices, and I don’t expect to see that for another few years. When you look at the amount of loan resets and their timing, 18 months isn’t even half way to the end.

Markets hit the boom at different times so it’s not surprising that they tip the scales during a decline at different times. Beaches gave you legitimate data that shows a decline in La Canada home prices. Be it median price on 10 properties (and I agree median price may not be the best way to go about it), but it’s the same method used to track sales/volume during the boom. Using averages isn’t any better. The 10 properties that sold shows severe drop off in sales volume, which preceeds declines in home price.

If you’re not convinced prices will continue to fall, then I suggest you go buy that house in the Oaks right now. If you wait, you might get priced out forever ya know. 😉

You must be referring to TheArcadian’s friends 🙂

In any case, it doesn’t matter what we say here or on any of the housing blogs. The correction will continue on regardless of what bloggers say.

Perhaps I’m way off and there isn’t a decline in Arcadia – who knows? But all the data I’ve seen points to a crash that’s unfolding before my eyes. I rather wait and see than jump in too soon and get burned. Buying at a slightly higher price than whatever the bottom ends up to be is better than buying before the bottom and hoping that it’s indeed well…the bottom.

Hello,

Very interesting and spot on.

I think the one thing that people can’t grasp, or dont’ want to grasp is the magnitude of what is going on. The numbers are so large that they almost start losing meaning, because we have no reference point to compare this too.

The scale of what is going on is off the chart, there is no infrastructure to deal with this size of economic disaster. Katrina and the Tsunami sort of come to mind, compare it to a economic nuclear bomb going off in Florida and California. One can argue that this economic disaster is going to have the same end result as if a Nuclear weapon went off in LA county, etc. I would also argue that this may be even more difficult to deal with because this is happening over 18 plus month period vs. a nanosecond. Sure, what I am saying can be dismissed as so much hyperbole… but when you begin to think of what is happening now, and try to plot possible event futures you begin to see that the future is very scary. We are in a “System of a Down”, or a negative spiral…. the energy needed to pull us out of this is so massive that it is beyond comprehension, and most likely beyond possibility. One almost can come to the logical conclusion, “well I better get mine, before the whole @@@@house goes up in flames”… thank you Jim Morrison…

Doubt me.. Just look at the chart…. then think of possible scenarios of what could pull us out… $600 rebate check… Bear Stearns bail out… The chinese gov’t buying every foreclosed upon house, and creating the worlds largest property management company… a small investment of 1 to 2 trillion dollars would do that…

Yikes that is the second time I have mixed up TA with SBG – sorry blogmasters! 🙁

With the cheap loans gone, the economy slowing, and banks being more selective there is only one way to go. The bubble was fueled by cheap money; that’s gone and it’s not coming back at year end. That said, the high home prices are not coming back either.

A home should not have to be a stretch on a family budget. A home is supposed to be a wise decision and a good alternative to paying rent. Not some pimped out loan where you need to put every last cent you have into the house payment.

If I never own a home in my life I don’t feel I will have missed out on the “American Dream”. In fact I think many people are finding the dream can be quite a nightmare when you worry about money every month.

On the other hand many “renters” are NOT living in equivalent homes, we are living in small 1-2BR apartments paying much LESS. So instead of buying that 800K home for $5000 month (incl prop tax and insurance), I’ll spend $1500 on rent.

Honestly, I am quite content with the extra $3500 cash in my pocket each month, lower utilities, and less worries. I know $42K a year is not a lot to save if a home is going up 100K year, but those gains are only realized when and if you buy and sell at the right time.

Once that same home hits $400K and the payment $2500 month then it makes more sense.

Sean,

My SO and I have been renting for the last 3 years and it was absolutely worth it. While our friends and family have been stressing over the value of their homes, we’ve been able to save enough cash for a wedding, 2 cars, mini-vacations and even fund a handful of hobbies.

Oh yea, we will even have a chunk of money ready for a downpayment.

I started off my working career making less than $40k a year and my friends are wondering how it is possible I can afford these things; let alone racking up 0 debt. There’s not much I can tell them but the truth:

Living a comfortable long-term life has very little to do with how much money you make and everything to do with how you spend it. The more you’re willing to sacrifice early on will magnify the payoff at the end (i.e. by renting, saving, giving up Starbucks, ect.).

That being said, I am definitely a home buyer waiting on the sidelines. There is a time to buy and a time to rent. As of today’s market conditions, it is the latter!

Puckhead – Wow, how much equity do you have? $250k for a single person, $500k if married is excluded from capital gains if it is your primary residence and as long as you or (both you and spouse, if married) have lived there 2 out of the last 5 years. And you don’t have to buy another house yet. It’s called the Taxpayer Relief Act of 1997. Now I don’t know if this law will or can change if we get a democrat in the white house. Here’s a good article explaining it:

http://www.bankrate.com/brm/news/real-estate/20041018a1.asp

If we didn’t have kids, we’d sell right now and rent.

I used to have mini-vacations…now I have kids.