Today’s new listing is a property that, for the right price, would be a decent home. Although it backs up against Michillinda, you get decent living space, a 10,400sf lot and what looks like a floor plan that can be worked with. Of course, the asking price of $788,000 rubbish….

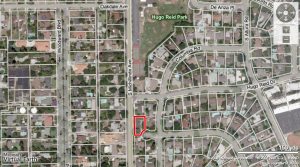

1151 Drake Rd.

Arcadia, CA 91007

Price: $788,000 ($485/sf)

- Beds: 3

- Baths: 2

- Sq. Ft.: 1,626

- Lot Size: 10,400 Sq. Ft.

Unlike most properties that slowly appreciated in value between 1996 and 2003, this one got an early start on the bubble:

Sales History

Sep. 1998 $310,000 ($190/sf)

Apr. 2000 $400,000 ($246/sf)

July 2002 $486,000 ($299/sf)

The last 2 owners made approximately $90,000 after two years of ownership. The current seller is aiming for a $302,000 profit after just 6 years! If this was 2006, I would have no doubt that this home would sell between $800 – 900k. Well, that is no longer the case and a $485/sf asking price for this 57 year old home unrealistic.

Straightline appreciation from 2002 gives us the following values:

3% $580,309 ($357/sf)

4% $614,945 ($378/sf)

5% $651,286 ($401/sf)

6% $689,400 ($424/sf)

My suggestion? List the property at $600k and allow the knife catchers or sideliners bid up the finals sales price. This is a sure way to get a quick sale and still walk away with a sizable profit.

What a great advice! But, it is difficult to give the property away, thinking just last year it was selling for $900K.

For low volume trade or illiquid asset trade, the best time to sell is when there is a buying frenzy. And, there is no buying frenzy on real estate anywhere.

Any owner of today just have to recognize where the substantial big and ask spread are, and willing to hit the bid when it appears.

If not, the seller will be just chasing the market down, and down….

I actually like this house, except that it’s on a busy street. Would not be surprise if it goes in the mid $700K’s.

You may be right about some knife catcher at mid $700k’s. And the buyer will regret as soon as he does. Because he is going to lose all equity in 2-3 years assuming he put down 20%.

What income level does it require to buy today at mid $700k’s? Perhaps with $150k down, verifiable family income of $130k is required?

A family of this income level should rent now and wait.

It is just a very dated 3/2 that might rent for $2800/month.

Odds are this one will sell for less than $500k in 2011.

I think people get way too hung up on “seeing their equity” disappear in 2-3 months mantra. The person/family that buys this house is most likely a move up buyer. There are not too many first time home owners that’ll shell out $750K+ for their first home. If you’re a move up buyer than the price of your current home will also go down in 2-3 when you sell it so it’s basically a wash. Selling your current home and renting for a few years does not always make sense. You may not be able to find a rental that goes to the same school that your kids go to and you’re unwilling to pull your kids out of that school. You may like and trust your neighbors. The kids have friends in the neighborhood and you trust to leave your kids at your neighbors for an afternoon. Stuff like that is priceless. If you’ve had your house for long time, rents may be more than your mortgage. If you plan to stay at your house for a long time and like your house and can afford the payments, I would not sweat the year to year fluctuations of RE prices

Puckhead,

I understand your point. Unfortunately, if you told that to the guy who bought from 2005/2006/2007, he’d most likely respond to you by saying: “Yeah, I’m in for the long-run, so it’s ok…”. But deep inside, he’s thinking that he should have waited just a bit. Or if you told that to someone who could have sold in 2005 but didn’t, he will also respond to you by saying: “That’s ok, especially since I’ll be living here for quite a long time.” Unfortunately, he’s probably thinking “I should have sold this damn place and rented, or at least downsized”.

Also, if you are a move up buyer, then that implies that the house you currently own is valued much less than the house that you are “moving up” to. Thus, if both of the properties decrease by say 20%, your original house value would drop much less on a dollar-to-dollar basis. (i.e. -20% of $750k is a lot more cold cash lost than -20% of $350k.)

An outdated 3/2 1600 sf $0.75 million as a move up? That just tells us how screwed up the real estate market has been.

Truthfully, it only works with bubble mentality. Because real estate prices only go up and someone always will buy it from me at higher prices in the future.

The 2005-2007 buyers with Option ARM 100% financing are walking away from their supposedly long term homes….

As Round 1 – Subprime crisis fades in the background, round 2 – the $1.6 trillion Pay Option ARM Implosion, is taking the stage.

http://www.youtube.com/watch?v=QjY8xVewrPg

phantom660rr,

I bought my first condo around early 90’s. I was underwater for about 5 years. Not once did I think “I should of this” or “I should have that”. I loved that place even with it being underwater. I think the major problem with RE is that people still view it as an investment instead of a place to live.

That was on the way down from the “bubble jr.” of the late 1980s. Do you dare to try again this time – the Great Housing Bubble. Please do with your bubbly equity.

>>I think the major problem with RE is that people still view it as an investment instead of a place to live.<>I think the major problem with RE is that people still view it as an investment instead of a place to live at an affordable and reasonable cost.<<

Thanks for the website on the Pay Option ARM Implosion. It is very useful.