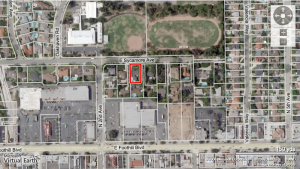

220 E Sycamore Ave.

Arcadia, CA 91006

Price: $887,000 ($435/sf)

- Beds: 4

- Baths: 2.5

- Sq. Ft.: 2,038

- Lot Size: 0.27 Acres

Today’s featured profile is at the request of an AHB reader. If you are ever interested in a property, feel free to shoot me a email with the address and Redfin link. I won’t promise anything but we’ll try our best to meet all requests.

This home is in need of 2 things:

- Fresh coat of paint.

- A new listing price.

Although the listing says this is located in the Highland Oaks area, it doesn’t change the fact that it’s bounded between a school/track field and what looks to be a commercial center to the South. Other than that, I’m a big fan of the circle driveway and lush landscaping.

Valuing this property based on last sales price will be difficult because the current owners have lived in it since 1964! Their purchase price? $39,500. It must be nice to sit on $887k of paper equity.

Applying the standard appreciation table we get the following values:

After 48 years of ownership:

3% $163,224 ($80/sf)

4% $259,536 ($127/sf)

5% $410,850 ($202/sf)

6% $647,558 ($318/sf)

7% $1,016,292 ($499/sf)

Not surprisingly, the 6% appreciation gives us $318/sf, a reasonable price for this property.

Of course, you can argue that “true” market value is what other comparable properties have sold for in the last several months. So here’s one located on the East side of the race track and looks to be in much nicer condition:

400 Hillcrest Blvd.

Arcadia, CA 91006

On June 3rd, it sold for $950,000 ($359/sf).

- Beds: 4

- Baths: 3

- Sqft: 2,644

Based on $359 per square foot, today’s property would be worth $731,642; about 12% more than the $647,558 value based on 6% appreciation. With the direction this housing market is taking, I’m almost certain that we’ll be seeing over 12% drops over the next 2 years.

Would you rent for 2 years if it could save you a quarter million dollars?

Very rational analysis on the fair price. I’d just add that this house could go below $500k in 2010 if we should suffer a prolonged stagflation with high unemployment rate of 8-10%.

Why below $500k? $3000 rent x GRM160 = $480k.

I am surprised that someone bought a house for $950K on June 3. Definitely a knife catcher. Can you find out the loan details? Did the new homeowner put down 20% or more and take out a 30 year fixed loan?

Matt, I personally know the Seller. He sold the property to his daughter. The 400 Hillcrest is not a reliable comp because it is most likely worth even more.

Thoughts on 400 Hillcrest,

It was purchased in 1987 for $210,000; an era facing its own housing bubble.

Let’s forget that the fact that housing prices bottomed out from the early to mid 90s. Assuming 7% appreciation over the next 21 years, this comp is worth $869,518 ($329/sf). Given some upgrades and proper maintenance, $950k seems reasonable.

Matt, according to PropertyShark.com, the maximum first mortgage was taken at $748,000 and a cool $202k was used for the down payment (21%).