That is the question.

That may not be Hamlet’s question, but that is certainly the question looming over potential buyers as they try to decide whether or not to purchase a home right now. I’ve said before that comparable rents is a key indicator of market fundamentals and I still think that holds true today. To truly account for all the pieces of the puzzle, prospective buyers should take all the factors into consideration. That means property taxes, HOA fees, maintenance, insurance, mortgage payments and the whole works.

While that may be the best way to go, it requires multiple calculations and as far as I know, most people don’t bring a laptop with them to open houses. Enter the GRM – gross rent multiplier. It’s a simplified version of the calculations that investors have been using for years. It’s not a precise analysis (as it doesn’t take into account paid utilities, taxes, insurance etc), but it wasn’t meant to be more than just a gut check. Using the GRM would give you a quick overview to determine whether the rental cost will cover the cost of ownership. This is a good tool for investors, but also very useful for potential buyers looking to evaluate RE values.

Overall Annual formula

Market Value/Annual Rental Income = GRM

Monthly formula

Market Value/Monthly Rental Income = GRM

There as been much debate as to what magic number is the “right” GRM. I tend to think there is a GRM range instead of a single value since it’s really just an estimate. Many have used the overall annual GRM of approximate 15 (15 x 12months/yr = 180 monthly GRM) for rent savers and approximately 8 to 10 (9 x 12months/yr = 108 monthly GRM) for cashflow investors.

Let’s apply this quick calculation to some Arcadia properties that are both for sale and for rent.

#1) 900 Victoria Dr. 91007

4bed, 2bath, 2034 sqft in Peacock Village

Rent $2900/month (Craigslist)

Asking Price $880,000 (Redfin)

Annual GRM: 25.3

Monthly GRM: 303.5

#2) 130 W. Longden Ave. 91007

4bed, 4bath, 2913 sqft in central Arcadia

Rent $3900 (Craigslist)

Asking price $1,328,000 (Redfin)

Annual GRM: 28.4

Monthly GRM: 340.5

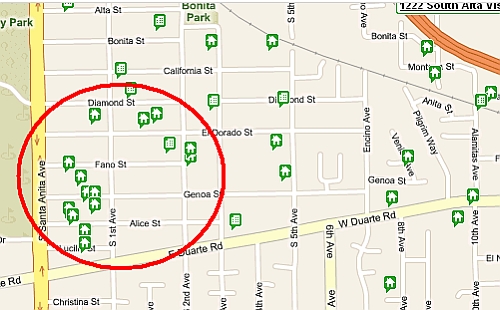

#3) Similar New Construction Townhomes

3bed, 2.5bath, ~1865 sqft off 2nd St.

Rent $2850 (42 Diamond St. Craigslist)

Asking Price $750,000 (50 Genoa St. #B Redfin)

Annual GRM: 21.9

Monthly GRM: 263.1

These are good examples how the gross rent multiplier can be useful. Although not a precise evaluation, these GRM numbers are so far beyond the traditional, acceptable range of 160-200 that there’s no point in even considering a purchase. Surely one can argue that the GRM is just an arbitrary number, but it only takes a few calculations to show that the ownership carrying costs for these properties are more than double that of the rental cost. It makes absolutely no financial sense to buy these homes at these prices when you can rent them for much, much less.

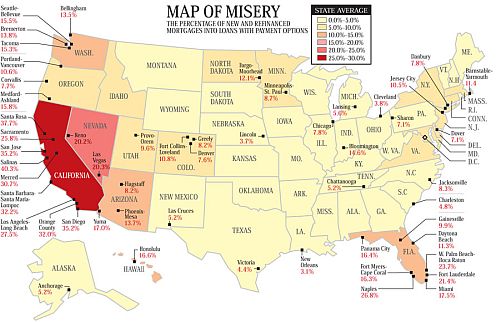

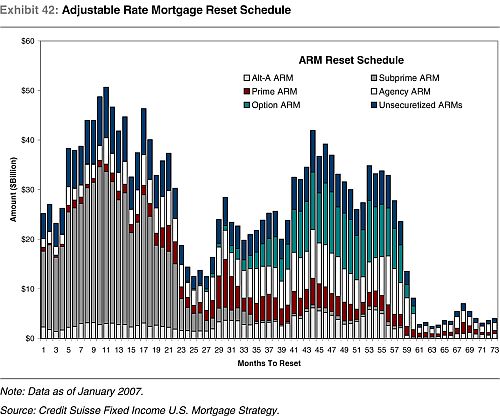

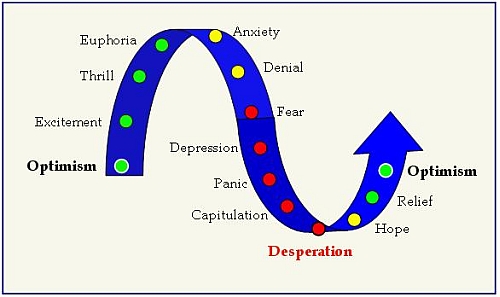

There’s a long way to go before rent savers and investors jump back into the market to create a bottom. The NAR will probably call the bottom five or six times before the actual bottom even begins to form. Sit back, grab a drink and enjoy the show.