Many have used what I like to call the ‘foreigner-rescue-scenario’ as the primary reason why Arcadia and other cities in the San Gabriel Valley will be essentially immune from the housing crash. I happen to disagree and would be remiss if I simply dismissed it without a closer examination.

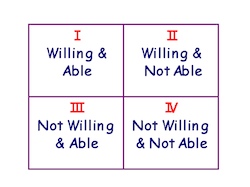

When kool-aid drinkers state that prices will remain at these elevated levels because of foreigner involvement, they are making several assumptions. These include:

- Foreigners make up a fairly large percentage of the demographic

- Foreigners are able to purchase these overpriced properties

- Foreigners are willing to purchase these overpriced properties

Let’s take this one at a time. From the recent new business developments and general observations in the city’s changes, these foreigners are mostly Asians. According to the 2000 US Census, Asians made up 45.4% of Arcadia residents and out of that 45.4%, about ¾ of them are of Chinese decent. That is not to say other ethnicities aren’t involved, but since the Chinese own the largest piece of the foreigners-in-Arcadia pie, they will be the race of interest for this discussion.

Although the census reported that the median family income in 2000 was around $66k/yr, it doesn’t account for the any of foreign money that have been brought in from the countries of the far east. Since it’s almost impossible to obtain data on how much money we’re talking about, it’s difficult to gauge its effect. However, for this rescue scenario to be effective there must be enough foreigners to carry the entire weight of the cities properties. Since the Chinese only make up one-third of the total population, it doesn’t appear this conglomerate of dim-sum eaters and rice-rocker drivers have enough power to pull everyone through. And even if that is the case, it would require each and every one of them to be fairly wealthy to make that happen. Is it realistic to assume that all Chinese residents in Arcadia are rich? I think not and that conveniently leads to my second point.

Even if these foreigners make up the majority of the population, they must be financially able to hold up the current market prices. People buy property in one of two ways. You can either purchase it in cash or take out a loan and pay a mortgage. I don’t know too many people with a million US dollars in cash, but I might just have a circle of poor acquaintances. Generally speaking, the majority of buyers (even Asian buyers) have a mortgage of some sort. With the crunchy credit crunch and tightening lending standards means borrowers must have some sort of downpayment and documented income to take out a loan. Fully documented income for a $800k loan would require a $200k/yr AGI. Even if the family income increased by 3%/year for inflation, it would only be $83/yr in 2008 and would finance a loan of about $350k. Many say there’s lots of Chinese money that isn’t taxed or recorded that can be used. Well, that would pose its own problem since the dirty money from China/Taiwan/Hong Kong isn’t documented, it leaves the only other option of putting down a larger cash downpayment.

So that brings me to the third point – foreigners must be willing to purchase these properties. Are these Asians willing to put down large downpayment and/or make large mortgage payments on what is now widely known to be a depreciating asset for years to come? I can’t answer for them, but if I had wads of cash on hand I certainly won’t be putting it into the housing market any time soon. These people aren’t dumb. Asians are typically frugal, hardworking people and they can be quite the bargain hunters. Many bought because of the good Arcadia schools so their kids can have better opportunities than they did, but assuming that these people will buy property regardless of falling home prices and market trends is absolutely ridiculous.

Yes, the good schools and proximity to Asian businesses and friends is a plus, but the Chinese buyers that bought during the boom were also investors and fellow kool-aid drinkers. They too were promised never ending price appreciation and saw exactly that for the past few years. Now that things don’t look so good anymore, do you think they will simply ignore the pent up volume, price declines, housing crash news and continue to purchase property? I think not.

This has ended up to be a fairly lengthy post. Let’s recap. The ‘foreigner-rescue-scenario’ could be a reason why housing prices in Arcadia will not fall significantly regardless of widespread foreclosure, increasing volume and falling prices across the southland if and only if there are enough rich foreigners willing AND able to purchase the majority of many distressed properties that will come on the market over the next few years.

Personally, I don’t see that happening. Do you?

Nice analysis.

I really apprecite your blog.

Nice to see someone focusing on the SGV.

I’m voicing my opinion as a Chinese American.

While I may look like a foreigner (since I’m not white ;)), my family has been in the US since the early 1900s. Most of the Asians that I know have had family members here for over 40 or 50 years. (I’m referring to over 1000 people that I know in the SGV.)

The Asians I know value hard work, education, and savings. Many of my relatives own multiple (up to six) single family homes or apartment buildings. These were purchased well before the 1990s. Many of these properties are paid off and are generating rental income.

My point?

1. A lot of those “foreigners” are Americans through and through. There aren’t rich foreign relative who are gonna give ’em cash. Heck, I don’t have any relatives overseas, and I’ve never been to Asia.

2. The Chinese people I know LOVE bargains. Nobody is gonna sell a property generating cash flow to buy a wildly inflated McMansion. The people I know don’t need the ego stroking or need to look rich.

Glad to be of service.

You know the right kind of people! The foreigners I was referring to are the newcomers I would classify as people who came to the states in the last 15 years of so. Your family I would definitely say are Americans.

Good analysis, but I have trouble with the premise in the first place. Just because LA is LA, Santa Monica is Santa Monica, and Arcadia is Arcadia, foreigners are looking to purchase homes here? Realtors have been saying this for years and years with respect to places like Santa Monica, and it just is not happening to the extent that anyone claims its happening.

Furthermore, Asian buyers, as I am, want value. No one is getting value right now. I think most of the people who say “foreigners want to buy here — they are going to run prices up, so you better buy now before they do” are probably realtors trying to get their 3% or 6%.

I’m glad that we share this view. Nothing any realtor says will change the course of the events to come.

Maybe someone older that I would remember this, but back in ’80s or early ’90s, many Asians were duped into buying property in Lancaster. It was hyped up as the next big real estate boom for cities surrounding LA.

Not only did Lancaster not take off, raw entitled land is currently worth next to nothing. I know because our company owns 55 acres up there.

So yes, when the market is skyrocketing, Asians will be there with everyone else to outbid one another. When the market sucks, they will store all their money in safe CDs.

Why else do you think there are so many small Asian banks in the SGV?

CancerDoc: I don’t even think the people who are sensationalizing the foreign rescue concept are referring to the Americanized Chinese. They are simply manifesting the handful of true instances where wealthy Asian businessmen, politicians and a small number of celebrities (remember Jet Li?) plunked down cash to buy McMansions – or in some cases, semi respectable mansions with good sized land. We were inside a beautiful mansion owned by a Chinese politician and I heard my Father saying: “This home was purchased by the People’s of Republic of China”. Oh how true.

However, take these heavy hitters out of the equation, we have ourselves what you’ve stated, hard working, frugal and value driven Chinese (or Koreans or Indians – both ethnicities are on the rise in Arcadia from what I’ve heard). I don’t think this was ever misunderstood by people vaguely familiar with Arcadia.

That said, I think the steady foreign influx do help, not rescue, Arcadia from crashing as badly as it should.

Corntrollio: I absolutely agree on Santa Monica. Prices are driven up and will experience only a soft landing largely because of wealthy local and transplant yuppies who rent or own, celebrities, the granolas and blue collars renters protected by the world-class rent control, foreign and local student renters and finally a good amount of executives who already own one or more homes in the area. Nobody is moving out, only coming in – well maybe the students but there are always new students. The wealthy can afford to leave the home as a vacation home and the renters can’t afford to move out due to rent control. The yuppies renters dream of owning a condo as a measure of their success. All of us renters and owners got used to the perfect weather and the beach living. All these drive up the market, foreigners have little to do with it.

One can buy a new 3/3, 1800sf in Lancaster for $250K. Where is Lancaster? Maybe it won’t be so bad?

From what I hear, Jet Li has since moved out and left Arcadia. The Chinese politician you were referring to is exactly the type of untaxed, unrecorded, dirty money I was talking about. Like you said, the foreigners help, but don’t rescue because there aren’t enough of them to fend off the crash.

As for Lancaster…have you been there? That $250k new 3/3 will be worth much less than that when all is said and done.

East West Bank, United Commericla Bank, Tomato Bank…the list goes on! Who in the world came up with the name Tomato Bank anyways haha

SparklingWater: My point was that just because someone is Asian doesn’t make them a foreigner.

UCLA did a profile of Asians in Calif about 3 years ago. Approx 65% of Asians are foreign born. So approx 65% of 75% of 45% of Arcadians are foreign born.

Now of that population, how many of them are truly foreigners? Take my parents. They’re both foreign born, but both have been in this country for over 40 years. They’ve both lived in the US far longer than they had in Asia.

Also roughly 20 to 25% of US born Asians hold degrees beyond a BA or BS. Are you going to tell me that there are many foreigners to have more money or a higher net worth than my ABC friends? I think not…

I may be at fault for this debate since I did not specifically define in the article what “foreigner” I was refering to. When I wrote this post, I was thinking of the (relatively) new influx of foreign money from Asia. Perhaps I should have said foreign-money rescue scenario instead of foreigner rescue scenario. My apologies.

I just located Lancaster – it’s quite far north! What’s up there?

I don’t think there’s a debate, at least none from my side. I was saying that CancerDoc need not worry that the general population will misunderstand all Asians to automatically equal to foreigners. I also said the concept of Foreign Rescue/Money was exaggerated by those trying to keep demands high and while it is true for a handful of instances, it’s more of an exception rather than the rule. Here’s the point where I’d debate. I don’t think it would prove anything to compare working class, albeit educated with BAs, MAs and even PhDs, ABCs versus (educated) foreign born Chinese. Both parties are looking for value and at no time did I imply the foreign born would have more or less money than the ABCs. I hope that clears it.

Jet Li moved to Beverly Hills several years ago and may have moved further West to Brentwood.

Yes everyone is looking for value and with the current prices, there just isn’t any out there right now. I agree – that applies to all sorts of buyers, Asian or foreign or not.

Hmmm…there is a prison up in Lancaster. Want to live there? Haha

I just want to clarify that these foreigners of Chinese descent don’t include the Taiwanese, who had moved to Arcadia long before this real estate boom happened and before all the Chinese immigrants came in and flooded the land (whether it’s 20 families living in one cramped apartment or wealthy businessmen plunking down cash for mansions). The Taiwanese population is significantly large in Arcadia; if analysis is to be made on residents with Chinese descent, I would appreciate if separate analyses were done for Taiwanese residents (or at least that we can be acknowledged) instead of just lumping us in with the Chinese.

Green,

Point well taken. I am Chinese myself and most of my friends are Taiwanese.

Asians of all descents; whether Chinese, Taiwanese, Cantonese or even Vietnamese, have all argued that Asians will rescue Arcadia and the rest of SGV from this housing crisis.

There is still a large non-Asian community along with existing Asians in the area and people tend to forget that it is the general demographic who will have the largest impact on the local economy. For every McMansion purchased by a foreigner, there will be a dozen condos and starter homes trading hands between low to mid income people earning anywhere from $40-80k per year.

Thanks for stopping by AHB. We appreciate your input and look forward to hearing more of your thoughts.

For Cancerdoc, I hate to say this but contrary to what you said, many of the recent immigrants from China are flush with cash (and care little about value or bargain). I have personally witnessed the increased $$$ from the PRC over the last 12 years-and yes-what you read about in Wall Street Journal is true, China’s economy is flying high-for now. While the majority of the Chinese are still fairly poor compared with the rest of the world, there is a growing minority, numbering in the millions, that are becoming filthy rich by profiting off of China’s cheap labor, lax regulation, corruption, and rampant nepotism/cronyism, etc. Quite a few of these individuals aspire to send their children to the West, or simply have a home in places like Arcadia as a status symbol. I believe in the past 10 years, much of the $$$ flowing into SGV real estate are directly from the PRC. I would guess the majority of the McMansion buyers in Arcadia are the nouveaux rich of China-with easy money flowing from corruption and bribes (e.g. coal mine bosses profiting off of public land, or customs officials ‘taxing’ every shipment of goods) 1, 2, or 3 mil USD is really a piece of cake for these guys. Until the PRC’s political/economic system shows some major cracks, which is possible in the foreseeable future in light of the current level of inflation and skyrocketing energy prices, the demand of wealthy buyers from the PRC will likely continue to support Arcadia’s astronomical real estate prices.

“…the demand of wealthy buyers from the PRC will likely continue to support Arcadia’s astronomical real estate prices.”

Last I checked, prices in Arcadia have dropped from the peaks in 2006/2007 so they are not holding up the prices. I don’t argue that easy money from the far East was used to purchase McMansions in the SGV, but I would argue that that buyer group alone will not be able to sustain these ridiculous RE prices. The bubble may have contributions from these corrupt nouveaux rich folks from Asia, but it was mainly fueled by RE purchases from every buyer group across all social and economic lines. That was made possible by the lax lending standards and now that is removed, so has the buyer pool that benefited from it in years past.

On a side note, if what you say will happen (i.e. corrupt rich Asians buying up most of the Arcadia RE inventory to keep prices afloat), then you can count me out of the local buyer pool because I don’t think I’d want them as my neighbors.