Today’s seller is facing the cold hard reality of our housing crisis and has been forced to reduce his listing price by 26.6%. We originally profiled this property back in March and many of you guys agreed that it was ridiculously overpriced:

Can’t See the Forest for the Trees

Original listing price: $1,350,000 ($614/sf)

38 E. Forest Ave.

Arcadia, CA 91006

New listing price: $990,000 ($450/sf, -26.6%)

- Beds: 4

- Baths: 2.75

- Sq. Ft.: 2,200

- Lot size: 7,570 Sq. Ft.

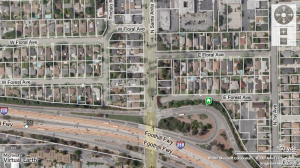

That’s a $360,000 price reduction! I’m not entirely surprised though because this “$1.35MM” home was situated right next to the 210 freeway, Santa Anita Ave. off-ramp.

For a home located south of Foothill Blvd. and next to the freeway, the price will have to come down a lot more because who in their right mind would spend nearly $1MM for this? If you value it at $300 per square foot, then this cookie cutter home would be worth only $660,000; $350/sf would give us $770,000.

Would you buy this property for $770,000? It might be worth a try because according to the listing,

SELLER’S IS VERY MOTIVATED. BRING ALL OFFERS.

Ugh! Next to the freeway and north of has to be the worst place — noise and pollution. I have a friend who lives next to the freeway and it’s impossible to relax in the backyard next to his pool. The house is well insulated so you actually don’t really hear the fwy noise if all the windows and doors are closed. He and his family don’t seem to mind, so I guess it goes to prove that people are very adaptable to their surroundings. However, I wonder about if the pollution has had an effect on him and his family over the past twenty years they’ve lived there.

For a 1M or even 3/4M, just having cars and trucks whizzing by all day would prevent me from even considering the house at any price.

My parents’ house is actually just 1 block away from the busy 60 fwy. As a family, we had no problem adapting to the noise, dirt and smog.

The thing is, my parents paid only $170k for a 1,400sf home sitting on a 12,000sf lot. For that price, they gladly made some sacrifices. I can’t see anyone doing the same for $1MM.

The kitchen looks horribly cramped and dark. It’s such a shame, as this was BRAND NEW construction. It doesn’t look like they utilized the 2200sqft very well.

CDOM (cumulative days on market) for the listing is currently 211 days.

According to public records, the current owners paid $506k in 8/2005 for the 912sqft 2/1 that was originally on the lot, and probably hoped for a big payday at $1.35MM

I would not live there given the bad location no matter the price.

Well, at least you could wave good bye to the husband each day as he gets on the on ramp to go to work……..

Or you can even deliver breakfast to the car because I’m certain he’ll be stuck on the ramp with all the other morning commuters. hah

Long time ago, I lived on Forest… and my impression is.. this house right priced is between 225 to 250 per sqft or lower.

Crazy talk… $5 bucks a gallon folks. Please don’t just shrug this statement off… $5 bucks a gallon is creating “fear”. This fear is forcing people to change the way they think. Buying a house implies a level of permanence that may not fit into the “end of cheap oil” world. So besides all the credit crisis mortgage issues, the price of the most persuasive commodity in the world is going up at an alarming rate. Whether or not it is “speculators” is a red herring isn’t it, because in the end, the price of gas is $5 bucks at the pump.

Sure I can blame the speculators all day long, but my short term economic reality is $5 bucks, and my long term economic reality is based off 3 options: the price of oil goes up, down or stays the same. Based upon this, buying a house may not fit in with some of my long term economic realities.

You may think that what does this have to do with Home prices…. The price of the house is going to move from a long term economic decision into a short term economic decision, i.e. house payment will have to be equal to rent.

I am probably a little crazy, and I know that I am oversimplifying the heck out of this situation, but I think that my concept has merit. The mortgage crisis combined with Oil prices is probably forcing a lot of people to take a wait and see attitude on a lot of long term economic decision.

Missed the bubble,

High gas prices are here to stay thanks to the booming economies of China and India. The impact of the high prices is that far flung places like the IE are are going to suffer much more than they are now. Very few people are going to want to commute 50+ miles each way just to own a house. However, the higher gas prices will make places like Arcadia, Pasadena and South Paz even more desirable as they are closer to more jobs. The urge to nest and own a house is a strong one, it’s going to take much more than that to make people rent instead of buy.