The internet has changed the way we live. From electronic shopping to scrapbooking, the internet has become the go-to source for researching just about anything. It’s completely changed the way people buy their airline tickets and turned the negotiation tables around on the car dealership show floor. There’s literally an entire world of information at your finger tips and people are taking full advantage of that. This is no different in the housing realm.

There is a wealth of information out there and anyone who chooses to look for it will find it. If you’re a regular reader on this site, you’re probably also a regular reader on many other housing blogs. In addition to blogs, you have a host of free services like Redfin, Trulia and Zillow that gives the general population information that used to be much more difficult to obtain. Even if you’re a renter, you can benefit from watching the market through Craigslist rentals. I alluded to this in my post about the future of real estate agents, but the growth of the internet has really put the ball in your hands.

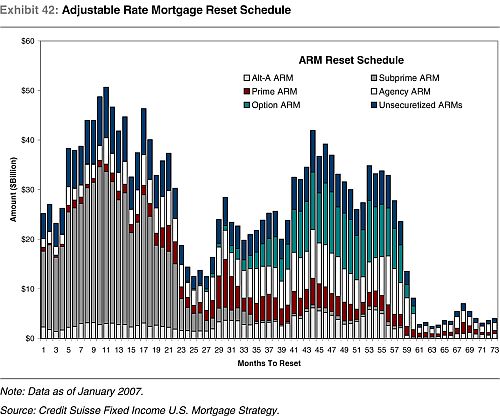

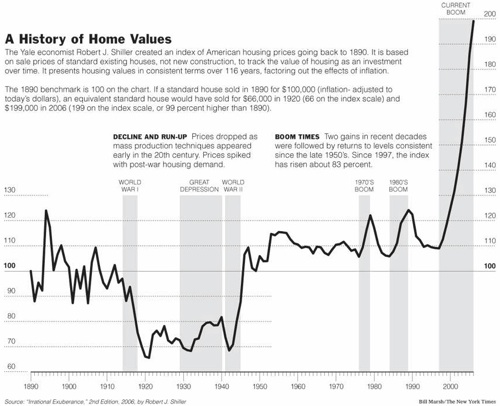

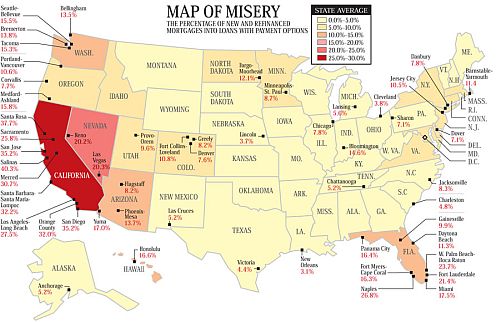

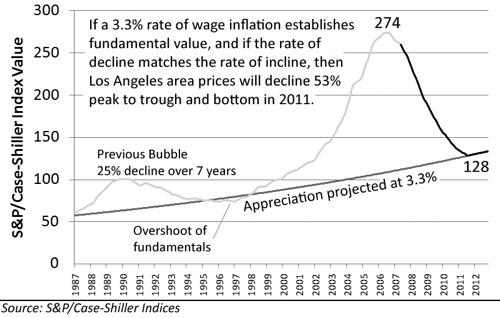

Are there people who still rely solely on their realtor for information and services? Of course. But as more and more people become aware of the vast sea of internet content, the landscape will change. Actually, it’s already well underway and the fact that you’re reading this post is testament to that. Knowledge is power. If the average American saw the charts you’ve seen and read the articles you’ve read, they’d be much less confused about the housing situation and would probably laugh at those NAR press releases that keep calling the bottom.

When people ask me about housing news, I point them to Patrick.When people ask me about finance and economics, I point them to Calculated Risk.When people tell me they’re mad about the proposed bailout, I point them to STHB.

There are a ton of other great housing-related websites out there. What are some of your favorites?