Another property has joined the $2,000,000+ club. This one is located in the beautiful Santa Anita Oaks area, or “Upper Rancho Estate”. Bordering close to San Marino and South Pasadena, homes in this community will always carry a hefty premium over other similar Arcadia properties.

Of course, there’s nothing normal about these homes either:

- 3,000+ square foot homes

- Up to 1 acre+ lots

- Well kept neighborhoods

- Privacy!

All in all, perhaps one would feel like they actually lived in the Hamptons… Not.

1050 Hampton Rd.

Arcadia, CA 91006

| Asking Price | $2,388,000 | ::: | Sq-ft | 3,649 |

| Purchased Price | $1,100,000 | ::: | Lot Size | 0.76 acres |

| Purchased Date | 1/29/2002 | ::: | Beds | 4 |

| Days on Redfin | 2 | ::: | Baths | 3.5 |

| $/Sq-ft | $654 | ::: | Year Built | 1940 |

| 20% Downpayment | $477,600 | ::: | Area | Santa Anita Oaks |

| Income Required | $597,000 | ::: | Type | SFR |

| Est. Payment* | $12,073/month | ::: | MLS# | A08087163 |

*Estimated monthly payment assume 20% down, 30-yr fixed @ 6.50%

Despite being in a desirable community located within a desirable city, this high-end home has a story to share with us. Take a look at its sales history:

Sep 02, 1988 $862,500

Jan 22, 1999 $870,000 (+$7,500)

Jan 29, 2002 $1,100,000 (+230,000)

Because the 1988 owner bought at the height of that era’s housing bubble, it took 11 years for the home to regain its value. This is not a theory or economic model. These are real sales figures that reflect what the opportunity costs is when you buy a home at the wrong time.

Fast forward 20 years later and we have the current owner who is trying to sell the same exact property for $2,388,000; a $1,288,000 premium over his 2002 purchase price. Of course, it looks like some remodeling has occurred:

- Updated bar

- Entertainment center

- Glass wall

- Salted pool & spa

- “Gourmet kitchen” /w stainless appliances and granite counters

- Hardwood floors, new carpetting, cabinets

- New wiring and plumbing

There are two things I know about remodeling homes:

- It can get very expensive.

- It did not cost the owner even close to $1.2MM to update this home.

Do I blame this seller for trying to make a buck? Of course not. It is my experience that 99% of property owners believe their homes to be more desirable than the surrounding neighbors. Apparently, actual sales and listing data reveals that $2MM+ is asking too much.

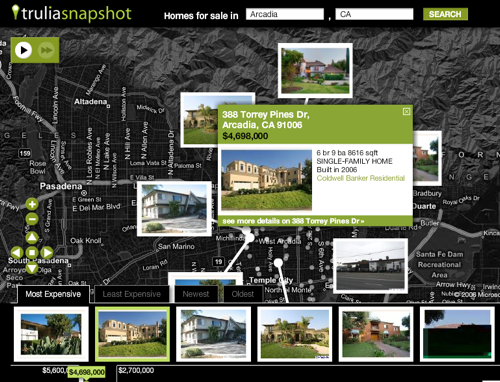

Recent Sales

$1,825,000

605 Arbolada Dr

Sold on Feb 05, 20084 br / 4 ba

3,473 Sq. Ft.$1,385,000

201 Adams St

Sold on Feb 05, 20083 br / 3 ba

3,716 Sq. Ft

Current Listings

$1,235,000

1030 Heritage Oaks Dr6 bd / 4 ba

3,265 Sq. Ft.$1,195,000

1030 Don Alvarado St5 bd / 3 ba

3,015 Sq. Ft.$1,425,000

79 W Orange Grove Ave4 bd / 2.75 ba

3,720 Sq. Ft.$1,295,000

230 Jameson Ct4 bd / 3.5 ba

3,178 Sq. Ft.$1,295,000

448 W Grandview Ave5 bd / 4 ba

3,821 Sq. Ft.

My theoretical offer on this home? I would give it a 5-6% annual appreciation over the last 6 years and maybe buy it for $1.5 – 1.6MM.