Zip Codes: 91006, 91007![]()

Current Market Listings as of May 10th, 2008*

Properties for Sale: 218 (+0)

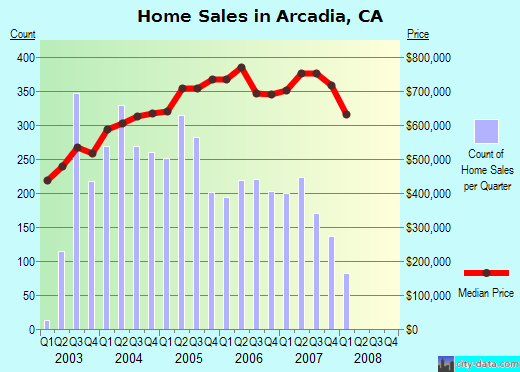

Median Listing Price: $779,000 (-0.38%)

Weekly Foreclosure Update*

Properties in Foreclosure: 23 (-1)

Properties in Pre-Foreclosure: 65 (-1)

*+/- is compared to previous week’s data.

495 days and counting. That’s how long the property below has been listed on the market. It’s a newly built detached townhome and from the way it looks, this home has been standing vacant for over a year (when it was first listed).

519 S. 5th Ave. #C

Arcadia, CA 91006

Listing Price: $768,000

Beds: 3

Baths: 2.5

Sq. Ft.: 2,002

$/Sq. Ft.: $384

This property’s listing price history is equally as impressive as its time on the market.

| Date | Price |

| Jan 26, 2007 | $779,000 |

| Feb 02, 2007 | $789,000 |

| Feb 24, 2007 | $809,000 |

| Apr 11, 2007 | $808,900 |

| Apr 29, 2007 | $819,000 |

| Jul 11, 2007 | $818,000 |

| Sep 04, 2007 | $798,000 |

| Oct 12, 2007 | $758,000 |

| Oct 16, 2007 | $718,000 |

| Nov 01, 2007 | $728,000 |

| Nov 02, 2007 | $739,000 |

| Nov 09, 2007 | $738,000 |

| Dec 19, 2007 | $769,990 |

| Dec 19, 2007 | $769,000 |

| Jan 11, 2008 | $729,000 |

| May 03, 2008 | $768,000 |

There are 13 units in this cluster of townhomes. From what I can see, the investor/developer who built these can’t afford to sell them for under $700,000. We profiled unit #B back in April that one eventually sold for $735,000 after sitting for 400+ days on the market.

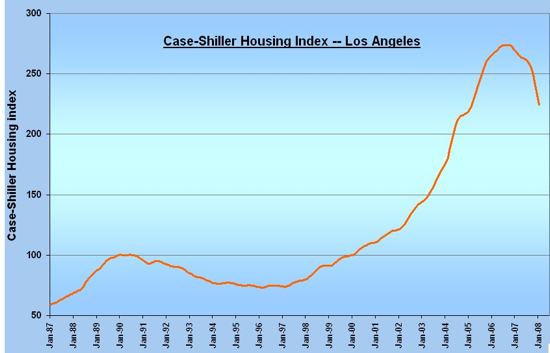

How many more months of interest will these investor(s) pay on their unsold homes? What was initially a profitable investment is turning out to be a big headache as these units continue to lose their value each week that goes by.

Property and foreclosure numbers obtained from U.S. Census, ZipRealty, Trulia, Yahoo Real Estate and Foreclosure.com. Market listings and price data obtained from DataQuick News.