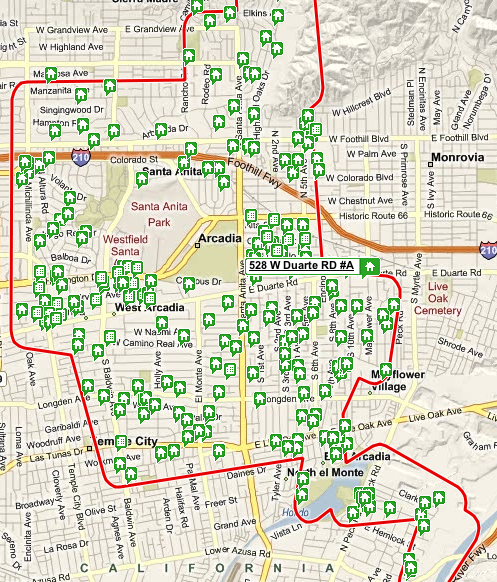

Zip Codes: 91006, 91007![]()

Current Market Listings as of March 22nd, 2008*

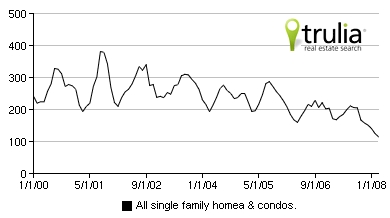

Properties for Sale: 245 (-12)

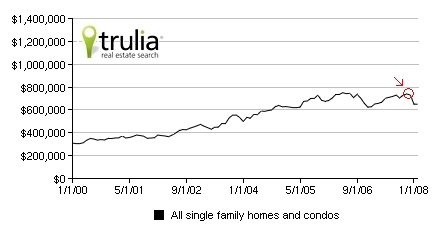

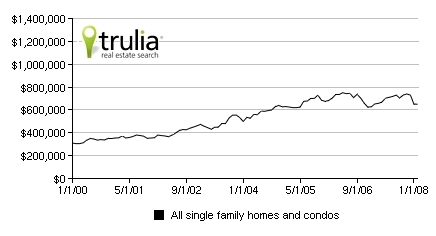

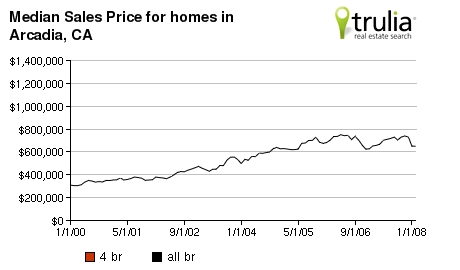

Median Listing Price: $775,000 (+0.7%)

Weekly Foreclosure Update*

Properties in Foreclosure: 17 (+2)

Properties in Pre-Foreclosure: 65 (-7)

*+/- is compared to previous week’s data.

As housing prices decline, many people are tempted to jump into the market and grab their piece of the American dream. It is no different than all the people who bought into Bear Sterns at $41/share. Peaking at over $150/share just one year ago, $41 seemed like a steal, right?

Wrong. Over the last 6 months there has been no shortage of news regarding Wall Street’s credit problems and no financial institution that exposed themselves to subprime was immune from it. Many people believed that the worse was over and we’ve hit near rock-bottom. Bear Sterns reached that bottom pretty quick at $2/share.

Unfortunately, this isn’t the case with the rest of Wall Street and definitely not with U.S. housing crisis. MarketWatch has reported that new housing construction are at a 17 year low and that “the housing recession is intensifying.”

It’s only been a year since the credit and housing bubble “popped” so if the early 1990s are any indication, then the U.S. housing recession is in for several years of pricing corrections. For those of you too young to remember the decline after the 90s bubble, I will discuss that next week!

Property and foreclosure numbers obtained from U.S. Census, ZipRealty, Trulia, Yahoo Real Estate and Foreclosure.com. Market listings obtained from DataQuick News.