| Asking Price | $1,198,000 | ::: | Sq-ft | 2,435 |

| Purchased Price | $402,000 | ::: | Lot Size | 0.45 acres |

| Purchased Date | 10/16/1992 | ::: | Beds | 3 |

| Days on Redfin | 11 | ::: | Baths | 2.25 |

| $/Sq-ft | $492 | ::: | Year Built | 1951 |

| 20% Downpayment | $239,600 | ::: | Area | Highlands |

| Income Required | $299,500/yr | ::: | Type | SFR |

| Est. Payment* | $6,057/month | ::: | MLS# | A08042694 |

*Estimated monthly payment assume 20% down, 30-yr fixed @ 6.50%

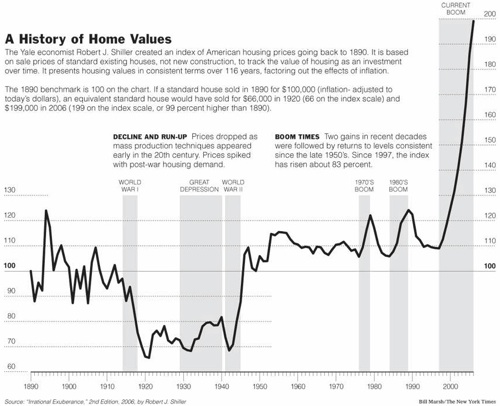

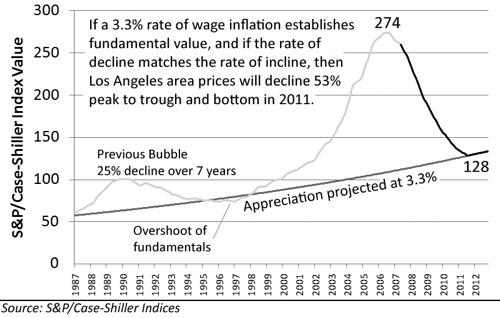

On the surface, this looks like any other overpriced listing. There was nothing special that caught my eye except for the rather large price drop in the previous post-bubble downturn. This house was purchased for $660k near the peak of the late 80s boom in 1988 and then sold for $402k just 4 years later in 1992. That’s a quarter-million dollar price drop, but I like to view it as 39% off the 1988 purchase price.

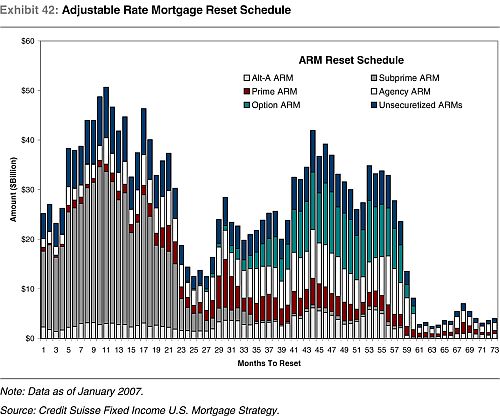

Don’t forget folks, 1992 wasn’t even the bottom yet and by comparison, the current housing crisis easily trumps that one. Will history repeat it self? We shall we, but let’s take a look at the current seller’s situation.

Purchase Price $402,000

Purchase Date 10/16/1992

Loan $202,300

Downpayment $199,700

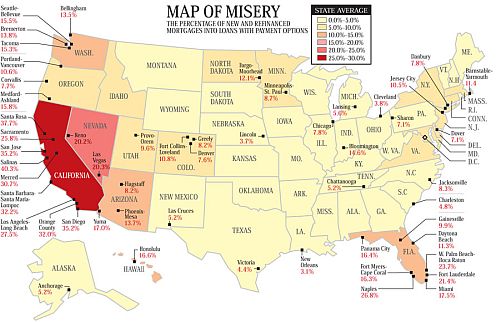

If the buyer was on a 15-yr fixed mortgage, the house would have been paid off last year. Instead of that, the seller pulled out multiple home equity loans. After all, home prices would increase forever and you can just refinance right?

Purchase Price $402,000 (10/16/92)

Refinanced to $650,000 (04/25/05) — $248k HELOC

Refinanced again to $916,000 (06/21/06) — $266k HELOC

Total HELOC Amount — $514,000Total debt now is now $916,000 after owning the home for 16 years.

Incredible. Instead of being mortgage free and therefore truly a homeowner who’s immune to the housing crisis today, she now owes close to a million dollars to the bank. From the description and pictures, none of the money was used to renovate or update the house. The choice to pull out over half a million dollars in cash to fund whatever lifestyle she lived for the past few years is a great example of the irrational exuberance that characterizes so many Americans.

With comparable 3bed SFR rentals going for $2,695 and $3,000 per month, it’s no surprise that this listing is over-priced. The GRM for this house would be 445 and 399, respectively – well above the 180-225 range where rent-saver buyers would enter the market.