It was by coincidence that I profiled 4 freeway-loaded properties this week. We did not go out of our way to find them and they are all new or refreshed listings. So it did not surprise me to find another unfortunate seller on the market. 13 days running… any guess when the first price drop with come?

Oh My Poor Katherine

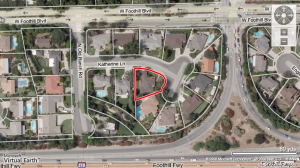

750 Katherine Ln.

Arcadia, CA 91006

Price: $850,000 ($392 per sq. ft.)

- Beds: 3

- Baths: 2

- Sq. Ft.: 2,169

- Lot Size: 9,620 Sq. Ft.

Oh poor poor Katherine indeed. This seller purchased the home back in 2006 for $800,000. They put 20% down and took on a conventional 30-year mortgage. Unfortunately, prudent borrowing will not save this family from losing money on their home.

At $850,000, this seller will most likely break even on their purchase (minus 2 years’ interest payment). To purchase an overpriced property sitting next to the freeway was a bad decision:

My Evaluation:

$300/sf – $650,700

$270/sf – $585,630At minimum, this home is $200,000 overpriced.

Other freeway profiles from this series:

Hello,

I think the price drop might be closer to 300k, but that is because things are changing.

Big fan of Itulip.com, and think this article will help you see why I think we are in more trouble then we think.

http://itulip.com/forums/showthread.php?p=39709#post39709

Good article, but nothing that most people paying attention to economy don’t already know on an intellectual level. The problem is how to overcome the emotion and instincts. Those of us who have been through economic downturns and past bubbles, know that things can get much worse than any thought. It’s tough to overcome with the financial news networks and media outlets urging investors to “remain calm” and wait for the recovery, etc. and the natural human tendency to freeze like deers in headlights and do nothing. Anyone still remember the Tan Man, Mozillo, telling investors how great things were last year as he was cashing out?

How bad can it get? Without money and investors from overseas, what prices would in Arcadia? It seems inconceivable the spigot of money from overseas will stop flowing like mana from heaven, right? Asians love the school district and will give their financial lives, living three generations to a house, to ensure the education of their children and grandchildren, right? Uh huh. Using median household incomes and traditional metrics to calculate “normal” housing prices…how much would the house on Katherine sell for…$200/sq foot, less? Inconceivable. Uh huh.

Interesting article with lots of graphs that does not tell me a whole lot more than what most people know. What I do find interesting is that at the very end of the article, the writer presents his current living situation below in quotes. Just substitute Euro for Asian currencies and gee, sounds a lot like Arcadia, South Pas and San Marino doesnt’t it?

“The town is at low risk to significant further home price declines due to a well diversified state and regional economy, unique proximity to several world class universities, and one of the best K-12 school systems in the US. Areas of the US that produce and retain highly trained and thus globally competitive workers will continue to attract population from other areas. For that reason, and due to the strong euro attracting European buyers, home prices actually increased 5% between 2006 and 2007 here and the appreciation is accelerating this year, as a result of migration from areas of the country and European buyers. Now, you didn’t think I’d choose to buy a home in an area where I thought home prices were going to bubble up and crash, did you?”

BTW, I just found on Zillow that the foreclosure profiled here sold for $724k and is already back on the market for $850k- https://www.arcadiahousingblog.com/2008/05/25/inventory-market-report-52408/

Wow! Thanks for the update BullDog. It looks like the new owner has setup themselves for a flip-gone-bad scenario.

Two fundamental metrics for Katherine:

1) Medium family income multiple (4): less than $500k.

2) Gross rent multiple (160): less than $500k.

$100k (in a year)- $300k ( in 3 years) loss written over it depends on how soon the new owner takes the stop loss.

It is amazing to me. There are still so many flippers out there even in today’s market. It is high likely the new owner is a realtor because my realtor told me that many her realtor friends did bid for this house. It will be interesting to see how long can this flipper hold on before he/she lose big.

Given the current bad situation of the Freddie Mac and Fannie Mae and the collapse of the IndyMac Bank, the real estate market will become more interesting.

I heard about the IndyMac collapse on my way home from work Friday. An associate decided to dump money into their 4% CDs earlier this week…

I have two friends who work at IMB; both up until a few weeks ago when I last talked with them insisted that things would be ok, at least that’s what they were told by management. The sad part is they sincerely believed it.

I don’t know if they will lose their jobs, but one had gone so far as to move all their 401k money into IMB stock back when it was still around $10/share. I don’t know how much but he has about 10 years with the bank in their finance department. Not quite Enron, but it still must have been shocking for some IMB employees this afternoon if they didn’t already realize how bad it was when the stock price slipped under $1/share recently.

Any thoughts on the effect on the local economy with so many local employees losing their jobs?

Oh, I am pretty certain that the pain will be felt throughout the local economy. Very few companies are expanding at the moment and those that are have many job candidates to choose from.

Weak housing, severe job losses and increasing prices on fuel, food and commodities will be felt throughout Los Angeles. Anyone who tells you otherwise is living in their own isolated bubble.

Local restraurants will definitely be impacted due to the layoffs. Just look at Irvine after the collapse of their local subprime lenders. Eateries went from overbooked lunches to empty store fronts literally overnight.

I took foreclosed home tour today in Pasadena. Most properties are owned by the South Hills Properties. It turned out this south hill properties belongs to IndyMac. No wonder IndyMac was closed.

Hi, can anyone point me to the website that calculates the risk of price drop based on zip code and cities for residential properties? I visited the site once before but forgot to save it. Thanks!

Yeah. This is four or five in a row located just north of the 210 west of Baldwin. I think you’ve got two or three of them by THE SAME OFFRAMP!

(I remember that offramp from 25 years ago, when I lived in Monrovia and worked on the far side of Glendale; used to pass it every morning.)

2 1/2 months…..just relisted for $649,900.

I can’t help but feel for the family after seeing the children’s furniture, as it doesn’t appear to be a flipper or investor. After all, these are my neighbors. I hope they land on their feet.

http://www.redfin.com/CA/Arcadia/750-Katherine-Ln-91006/home/7229278